My previous article describing the decades leading to the crash:

In this article we will examine the crash itself and the honest history.

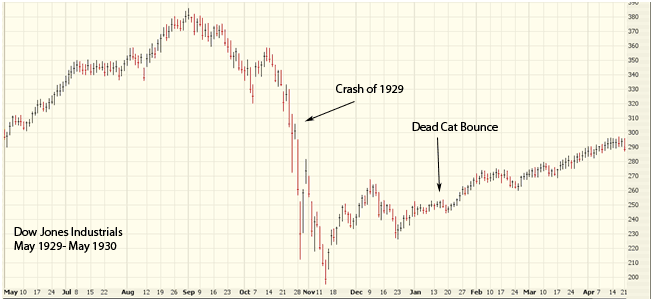

1929

The whole world was getting used to Investing in stocks and borrowing money to invest in stocks seemed like a good idea. It turned out not to be a good idea as the whole world was doing exactly that.

And when there is an abundance of something combined with The Tentacles of the Federal Reserve Gripping the American Banking System starting 16 years prior; this caused the ugliest market correction which affected the whole world. America was a beacon for world markets. The narrative taught in schools in America teaches to this day is:

The New Deal and all the plans the government put in place to stimmy the affects of a financial asset crash and credit bubble was the solution.

Source: Lake Zurich High School, Lake Zurich, Illinois (2004-2008)

Depressions only become "great" when normal to severe depressions are used as excuses for massive increases in government intervention. [1]

The Real Solution would have been to jail the creditors of the margin trading. The creditors of America were the 12 Branches of the Federal Reserve and their shareholders.

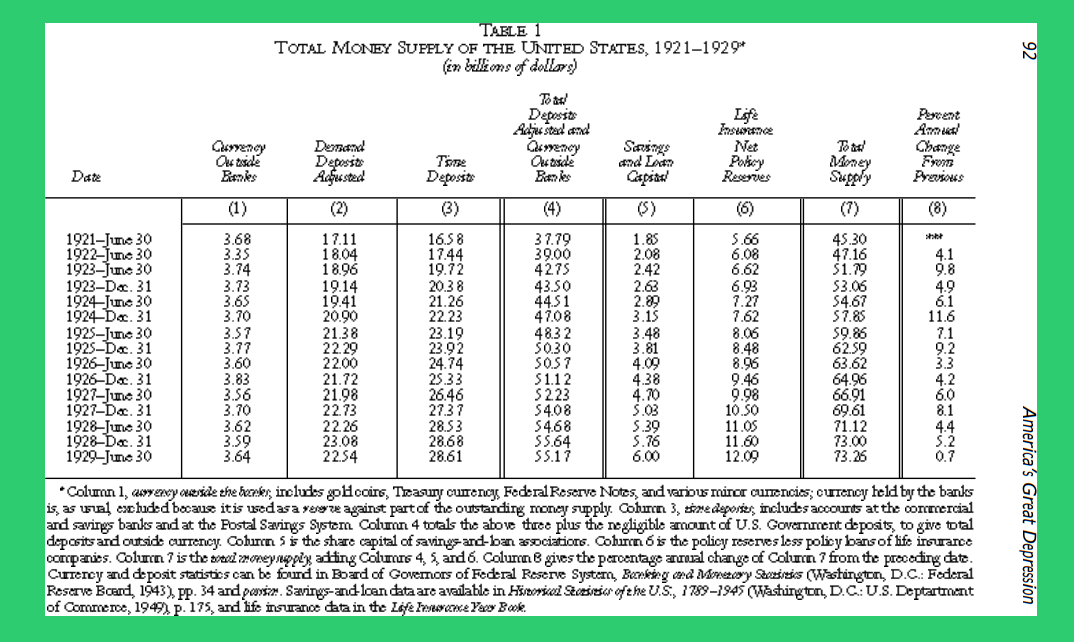

Here is a chart of the money supply showing the willful evil ignorance of the bankers in fluctuating the money supply in the years before the crash:

The total Money Supply, column 7 above, increased from 45.30 Billion Dollars to 73.26 Billion Dollars from June 1921-1929; an increase of 61.7% in 8 years before the crash.

The delusion that Dollars held their value was slowly becoming untrue after the Federal Reserve manipulated the money supply. They were papering over the markets with dollars, causing companies to think they were more profitable.

This was a day in age before there was digital market data across the globe for every asset. However, rich investors had access to telegrams and were adept at world markets.

The whole world started to get fascinated with Stocks seeing the money that was coming out of the paper money laissez-faire roaring 1920's where American's in essence lived happily as they had the dollars first before they lost value across the globe.

The margin credit scheme fueled hopes in the roaring twenties along with Electricity, Telegraphs, and endless other productive inventions were lost due to the evils of creditors and the ignorance of the new stock investors.

Then you go to jail, like Ponzi, or commit suicide, like Ivar Kreuger.

There is nothing new in the scheme. What is new is that for the first time the whole world tried it. The whole world cannot put itself in jail, nor can it escape the consequences by suicide. When the delusion breaks, people all with one impulse hoard their money, banks all with one impulse hoard credit, and debt becomes debt again, as it always was. Credit is ruined. Suddenly there is not enough for everyday purposes. [2]

Credit was ruined for everyone, including good businesses. And this prevented business from weathering economic conditions due to the reduction of credit. Further interventions after the inflation even caused hunger in the most Fertile Country on Earth.

The Woodrow Wilson led solution "As his admiring biographers, Myers and Newton, declared, “President Hoover was the first President in our history to offer Federal leadership in mobilizing the economic resources of the people.” [3]

How endearing, let's mobilize the economic resources of the people. However, this is what caused the prolonged depression seen in every home. The solution of Hoover was to intervene, and no other President in America held this belief.

"Hoover acted quickly and decisively. His most important act was to call a series of White House conferences with the leading financiers and industrialists of the country, to induce them to maintain wage rates and expand their investments." [3]

This was the start of what would later become known as The New Deal, forcing businesses to act in concert according to committees in Government:

"The President’s conference has given industrial leaders a new sense of their responsibilities. . . . Never before have they been called upon to act together . . . in earlier The Depression Begins: President Hoover Takes Command 213 2 Irving Bernstein, The Lean Years: A History of the American Worker, 1920–1933 (Boston: Houghton Mifflin, 1960), p. 253. recessions they have acted individually to protect their own interests and . . . have intensified depressions." [3]

The gentle words of Woodrow Wilson have led us down into hell. We are still living in a world where lobbyists and bankers decide our fate, tax rates, and how much of our food we sell to China. This lunacy has to stop.

All President's in my Life, George W Bush, Clinton, George H.W. Bush, Barack Obama, and now Donald Trump have learned nothing from the Austrian School of Economics, or they are completely corrupt.

I can not believe I just donated $50 to Donald Trump, but more intervention from B for P would not be good.

Please forgive me Hive, I should have bought $50 of HIVE.

Thank you for reading, rock on Hivers! We will be fine... as most of this has become common knowledge in the crypto-world and among all people who hold money.

On the note of Hive, it's the new social media. First 5 people who join and post an #introduction photo will get 50HP delegated for 2 months:

References:

[1]

[2]

https://cdn.mises.org/The%20Bubble%20that%20Broke%20the%20World_2.pdf

[3]