Is Great Depression Season 2 Knocking the door?

Highlighting the world economic current situation! The global recession may possibly convert into Great Depression if economic situation do not improves!

The Backdrop

Ever since the Financial Tsunami, as coined by Andrew Chang in 2009, the US economy has not fully recovered. This financial shock also severely impacted the EU economy, where many EU countries are not yet stable! As economists and I had observed that before the 2009 crisis that was somewhat triggered in 2008, the US economy has faced a huge loss due to natural calamities. This loss has contributed significantly as it crashed the subprime market! From 2005 to 2008, the total loss to the US Economy was around 200 Billion USD. This loss net effect after taking into account the multiplier effect, shall be not less than 400 Billion USD. This is so because of the lags due to destroyed physical assets and disturbance caused to human resources. (article continues below)

Similarly, this time for the period of 2016 to 2019, the loss was 511 Billion USD, which is twice more than the last times base for Financial Tsunami! Now, if the Multiplier is considered at 1% being too pessimist, then it shall be 1.022 Trillion USD of loss. The global recession in 2020 has been pointed out in 2018 by many notable economists! Why I am talking more about the USA is because it is the world leader and if the US economy is affected than the whole world is affected! This can be easily understood by the last financial tsunami!

Interestingly a new concept in economics was faced during Financial Tsunami that is under thorough analysis and it was “for the first time in the history being observed that the local currency of the country (which is the epicenter of the crisis) was getting stronger and the local currency was flowing back to the crisis country”! As this was not the case during the 1999 economic crisis of Southeast Asia, where the local currencies of the countries were crashing! Thus, here the USD was growing stronger and was being bailed out by the rest of the world to remain stronger!

The Scenario

As per the data of IIF (International Institute of Finance), “Global debt across all sectors rose by over $10 trillion in 2019, topping $258 trillion. At over 331% of GDP, global debt is now 40 percentage points ($87 trillion) higher than at the onset of the 2008 financial crisis—a sobering realization as governments worldwide gear up to fight the pandemic.”

The above statement shows how the world economy is moving towards the debt trap, and this time, it is much bigger than ever! The more fearsome data that highlight the concerns over are the growth of global debt stock and credit of NFC’s since 2007 – 08. As per Kozul – Wright, the “global debt stock share of the EM’s (Emerging Markets) was only 7% in 2007 and the same share in 2017 is 26%. Furthermore, the credit of NFC’s was 56%in 2008 and the same credit of NFC’s in 2017 was 105%.

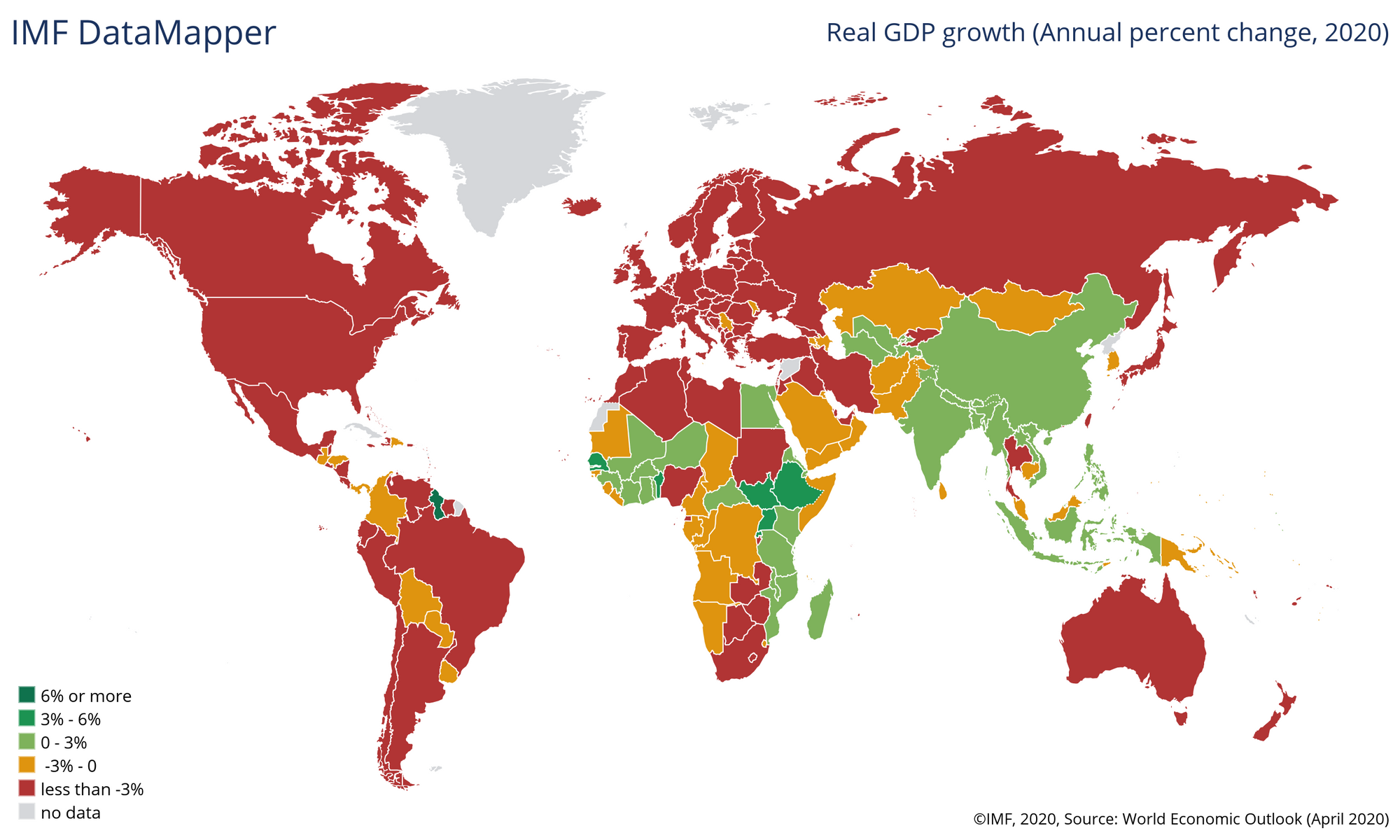

The above analysis clearly says that we are sitting on a financial crisis bomb which is far more devastating than ever! The picture below states the situation about the Real GDP 2020 of all the countries which are alarming!

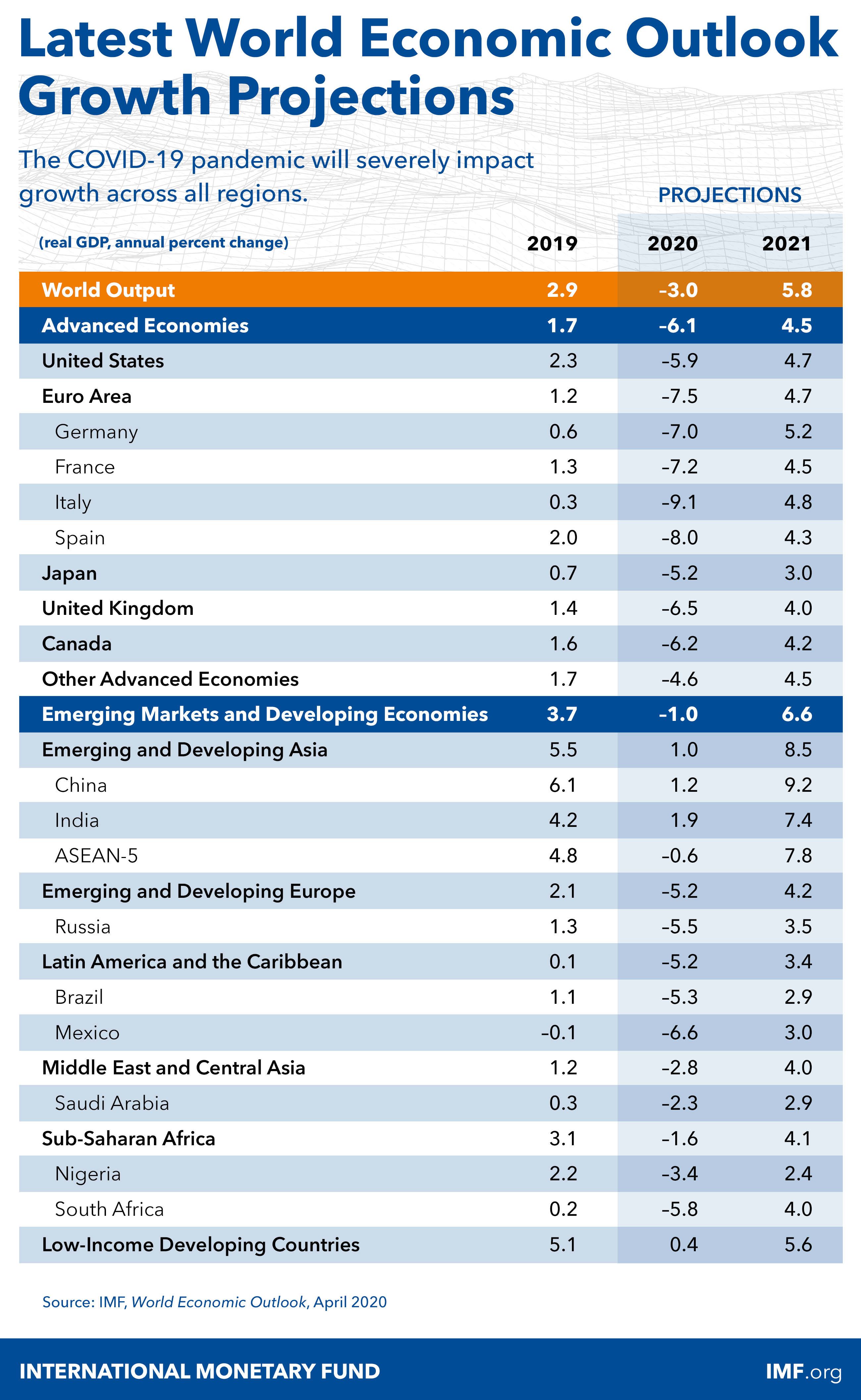

From the map above, one can see that only a handful of countries in the world are in positive Real GDP in 2020 and the rest of the world at large is in negative Real GDP, whether it is North America, Europe at large. The whole of South America leaving Guyana, Australia, the majority of Africa and some countries in Asia! The table below shows the data of the important economies from the last quarter of 2019 till the 2nd quarter of 2020. The table shows the projection for key countries where US Economy is -5.9% this year and all big economies are in a negative growth rate zone!

The chart below clearly shows that leaving China, all other economies in the world are in the negative quadrant in the 2nd quarter, where India has joined this negative zone only in the 2nd quarter of 2020! Hereby, as per the official definition of Recession, “If an economy has a negative growth rate for two successive quarters, then it is called Recession.”

Thus, from the definition, it is clear that the world economy or globally the world is in a recession! If this financial turmoil is continued for another couple of quarters or if the negative growth rate rises beyond the threshold, then the world may enter Great Depression Season 2 which will be far detrimental for the people across the world.

The fear of mine and I am sure of many economist’s worldwide on the following counts:

- The situation of the global recession has been worsened on the pretext of COVID – 19. The prediction of this global recession was there on the cards but not this severe that it can lead the world into the Great Depression

- The Corona does not seem to go anywhere till July 2021 (as per my prediction). This is so because even after the launch of the medication, it will take time to cater to the huge population of the world.

- The soaring high numbers of patients will put pressure on the medical facilities, especially the Emerging Economies which will face the worst brunt. These economies will lose a considerable portion of their labor workforce. This workforce is the backbone of any economy to grow! In regard to India, its growth is majorly supported by the tertiary sector shall face a bit less brunt of it, but still, a huge set back is on the cards.

- The failure of Keynesian Theory being developed during the Great Depression Season 1 and also the failure of Brexit in context to many countries will be like moving without a lighthouse in these challenging times.

- Moving of the world economy towards the debt trap is another aspect, as already we are at 258 Trillion USD that mounts to 331% of GDP as per IIF, which is too high a number.

- Gross government debt issuance in regard to COVID – 19 is almost 16 Trillion USD

- COVID – 19 has pushed debt in mature markets 392% of GDP as per IIF.

- 60% of global debt is maturing by the end of 2020, which will again put pressure on the governments!

- Further lockdowns and loss of lives are costing the world economies and will also contribute to pushing the world economy into a possible Great Depression.

- The rising prediction of a possible war on China can throw the world into Great Depression, as the production of G&S will be halted in the affected areas. Loss of physical assets and workforce will add to it.

- The use of money for arms and ammunition which is unproductive in nature, will put more pressure on the fiscal deficit of countries.

- The shifting of the industrial base from China SEZ’s to some other economically viable country will have a high cost that will add to the debt market. This will push forward the lag w.r.t. Supply-Side Economics to cater to demand. Thus, creating inflationary pressure in the economy.

- The increasing loss of the tertiary sector, w.r.t. travel and hospitality, may force many to file bankruptcies. Leading high economic loss in the form of a contribution to GDP and its parameters with mass unemployment. Tourism based economies to be the worst-hit like Malaysia, Thailand etc.

On the above counts, if all worst happens then in my opinion, the world economy shall enter The Great Depression Season 2 by the end of the year 2020 or the 1st Quarter of 2021!

The Endnote

The world has to find another way or an alternative to Keynesian and/or Brexit to guide the economies to sail through these turbulent waters! The new face of the world to emerge after the rise from these troubled times is on the cards. The time to come will change the face of the business world, as it is the need of the hour! The corporates have to use technology to its fullest to cut down its costs and ensure to pass this benefit to its customers to be there in the market in the very long run period. The virtual world shall take over the physical place concept in many ways and dimensions!

Hope for a better world with flourishing economies, where smiles than Pandemics are present, which do not throw a world economy into global financial crisis!

Recommended reading: