The origins of the Federal Reserve system were connected politicians, Keynesian followers, select bankers, and a secret meeting in Jekyll Island, Georgia.

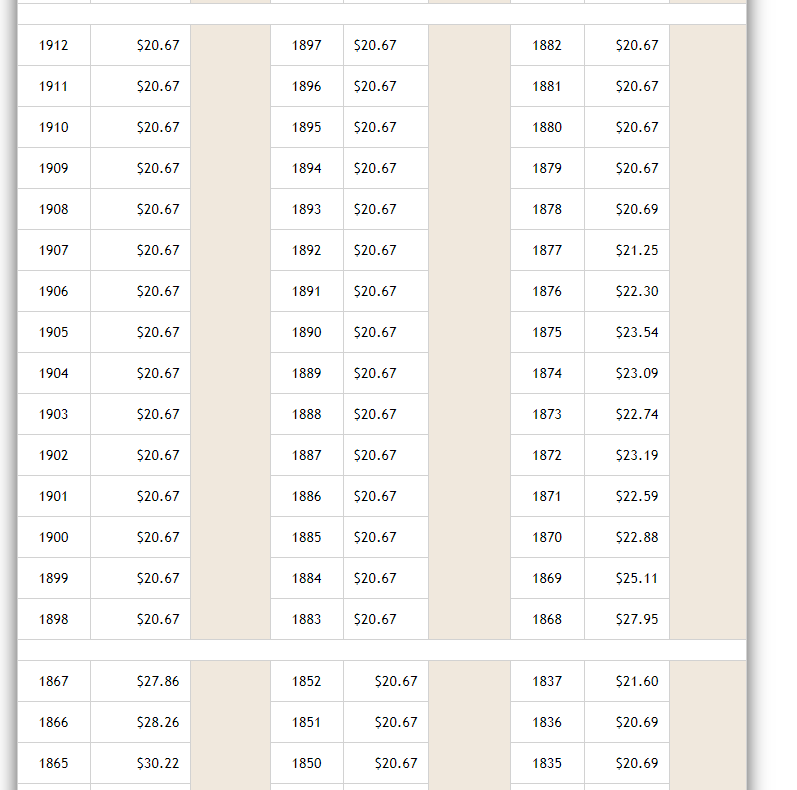

Prior to 1913 the price of gold looked like figure 1:

As you can see, very predictable and a solid foundation of which a market can be built. After 1913 the gold price looked as follows, I use Gold because that was the most popular form of collateral for banks worldwide:

The price from 1913-1955 was set at a fixed rate as they couldn't sneak away from a gold backed banking system quite yet. The price was $20.67 at 1913 and stably rising at a fixed rate based on 'credit demand' up to $35.67.

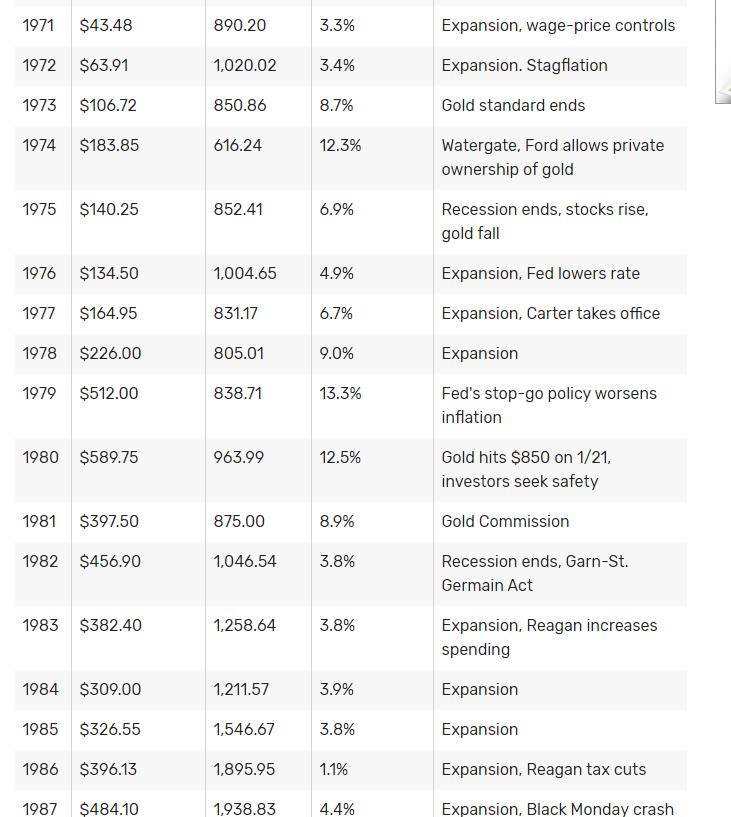

Their pushing of credit through the system in the form of increase in the Dollar (Federal Reserve Note) money supply led to what we see above. The credit markets are priced almost purely at the discretion of the Fed which is a dangerous game when you don't have the whole market determining the price of credit. As you can see it fluctuated and they caused booms and busts which certain government schools blame on markets failing and a natural business cycle.

The price from 1955-1971 was fixed at around $35.00 based on an agreement with all the major economies grappling them into the Central Banking dichotomy which they preached as modern science. Saying that, I mean now the whole word was looking to what the US Fed, Bank of England, major banks were doing and this provided an arena for International Banking with Airplanes, data lines, Telecommunications, etc.

From 1971 onward we have had a complete disconnect from a stable gold price.

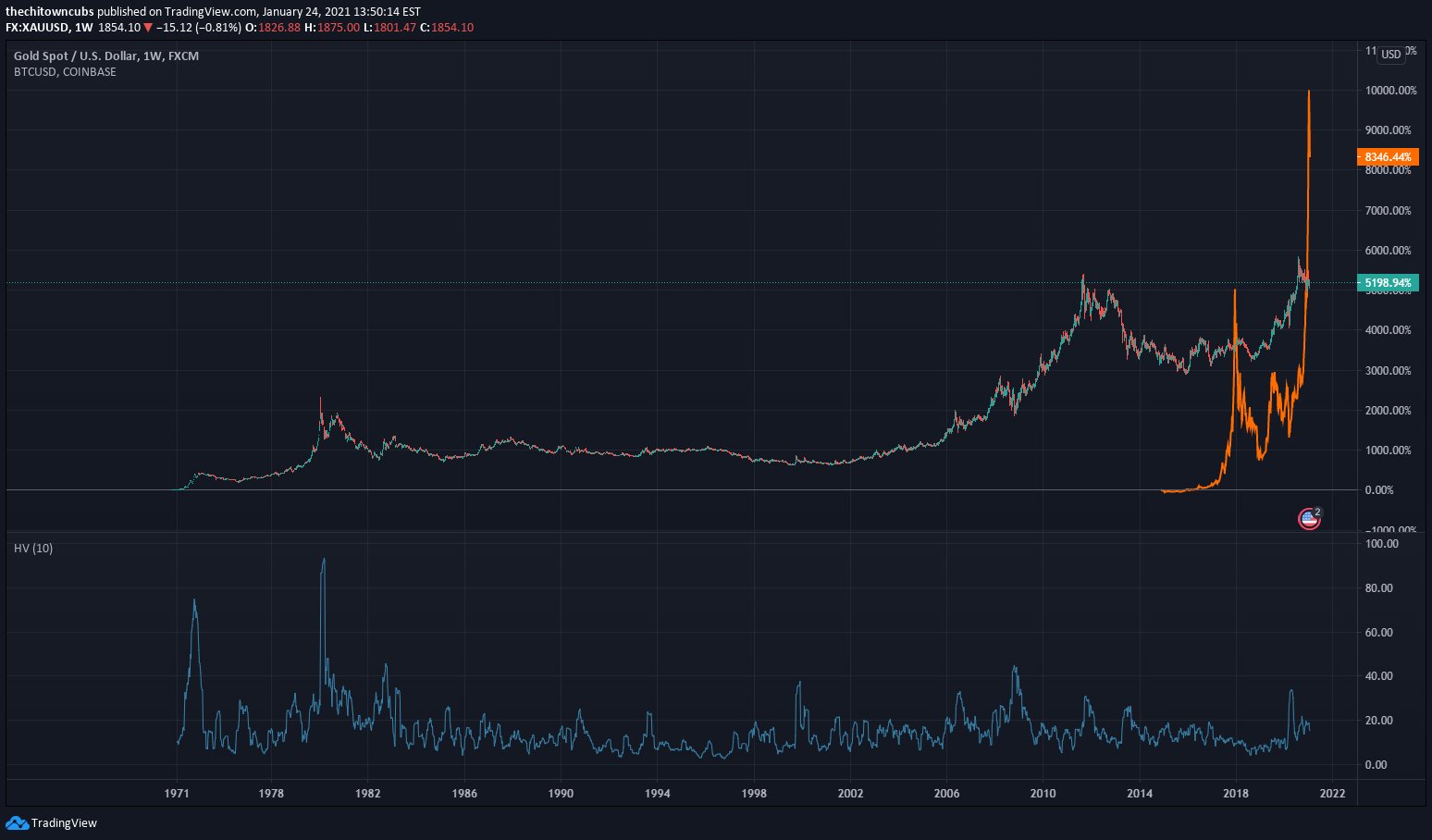

Here is a chart of the price from 1971 and then Bitcoin after the awakening of the world to the Central Banking cartels, Military Industrial Complex, Drug Trade by Intelligence agencies at Governments, thanks to the internet.

I hope the world starts pricing in a rare commodity again as banking collateral. Using Paper money when they can turn it on and off at whim has led to this Clown Market I call it where you have complete idiots at the Banks who are preaching out of you know where of what stocks to invest in now. They don't want to end their worldwide cartel but certain extremely rich traders are keeping the market pumped in a central bank mish mash.

Expect a major Utopian society with a properly educated population on the importance of a Stable commodity/currency as Collateral. The most recent are Bitcoin and Ethereum which are based on a Digital ecosystem. Which provides many advantages as you can see with the chart. We have yet to find a price ratio vs Dollars for Bitcoin yet. Gold is old and more prevalent than bitcoin, but still has industrial uses where bitcoin has positive velocity momentum in real markets, a complete secure system, and programmatical uses.

Thank you for reading, and if you have any questions please comment or hit our Chat button in the bottom right!

John