Can India Survive this Current Crisis of 2020 Like in the Past?

This article is an attempt to analyse why Indian economy was not affected by previous crisis severely and can Indian economy repeat this time of global recession? What are the factors affecting the India's GDP growth rate in 2020 2nd quarter!

The Backdrop

Since the 1st Great Depression of 1931 and the Financial Tsunami of 2009, the Indian Economy has not been the recipient of severe economic loss and has always survived and emerged stronger than ever. During the Southeast Asian crisis time as well, the worst brunt was faced by Indonesia, Malaysia, Thailand, South Korea, Philippines, Hong Kong and Laos, where Brunei, Singapore, Taiwan, Vietnam and mainland China were less impacted with Japan. The currencies of these countries started slumping down and the timely intervention of the IMF to bail out these countries with a 40 Billion USD rollout. As in my earlier article, I have discussed that the global debt in the month of August was around 258 Billion USD compared to 140 Billion USD since the last financial crisis of 2009. Similarly, the debt of these countries was 167% that made their currencies trembled. The question is why the Indian economy did not take a severe hit? Secondly, will this time also the Indian economy be saved? (Article continues below)

The Scenario

During the previous crisis also, the Indian economy was majorly saved because of the backbone of the Indian economy, i.e., Small Scale and Cottage Industries and small vendors etc. During the last financial crisis of 2009, the impact was not felt across all the sectors! They are restricted to the IT sector and Financial Markets with some impact on travel and FI’s or the sectors having interaction with the US Economy. Thus, the EU, Japanese, Chinese, South American, Gulf Countries etc. economies at large were the worst hit ones! As, these were having a high interaction with the US economy, so the hit was also challenging. The magnitude of the loss was so high that the entire EU could not bail out the US economy at that time. Since then, the US economy was facing a recession now and then or low GDP positive growth rate in hands with many EU economies like Greece which was saved from being bankrupt.

The Indian Economy has large Small Scale and Cottage Industries with a large number of small-time self – employed who act as the backbone of the Indian Economy! Furthermore, the Indian economy is also characterized by a high rate of Savings!

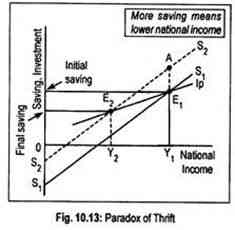

There is a very interesting story I recall every time from this concept of Savings w.r.t. economics. The Paradox of Thrift is a very famous set of equations shown by the flow chart movement that says, “The higher the Savings lower the Consumption and National Income in the subsequent periods in the economy.” But interestingly, when the Great Depression of 1931 struck the world economy and worldwide economies shattered down like a card house leaving the Indian economy, it sent the top runners into awe! When theories of economics were failing, J. M. Keynes, the famous Noble Laurette economist, came up with the guidepost to thread those troubled waters. His theory of the Psychological Law of Consumption was the hero by saving the world economy.

His masterpiece theory developed a new circular flow of income model that was the next level of attainment of an economy i.e. 2 sector model with Saving and investment. Prior to this model, there was only a 2 sector model without the Saving aspect into it. This Saving part was added to the model because it is only the savings that saved the Indian economy in troubled times! Thus, thereafter even in 3 sectors and 4 sectors models of the open economy welcomed the Saving and Investment trade-off! J. M. Keynes has very beautifully drafted and shown the analysis of Saving and Investment dynamics within an economy that can take the economy to a new high while supporting the poor and economically weaker section of the economy. Here, in the model, he has also introduced the financial intermediaries who channelize the whole set of Savings and Investments of an economy for this purpose.

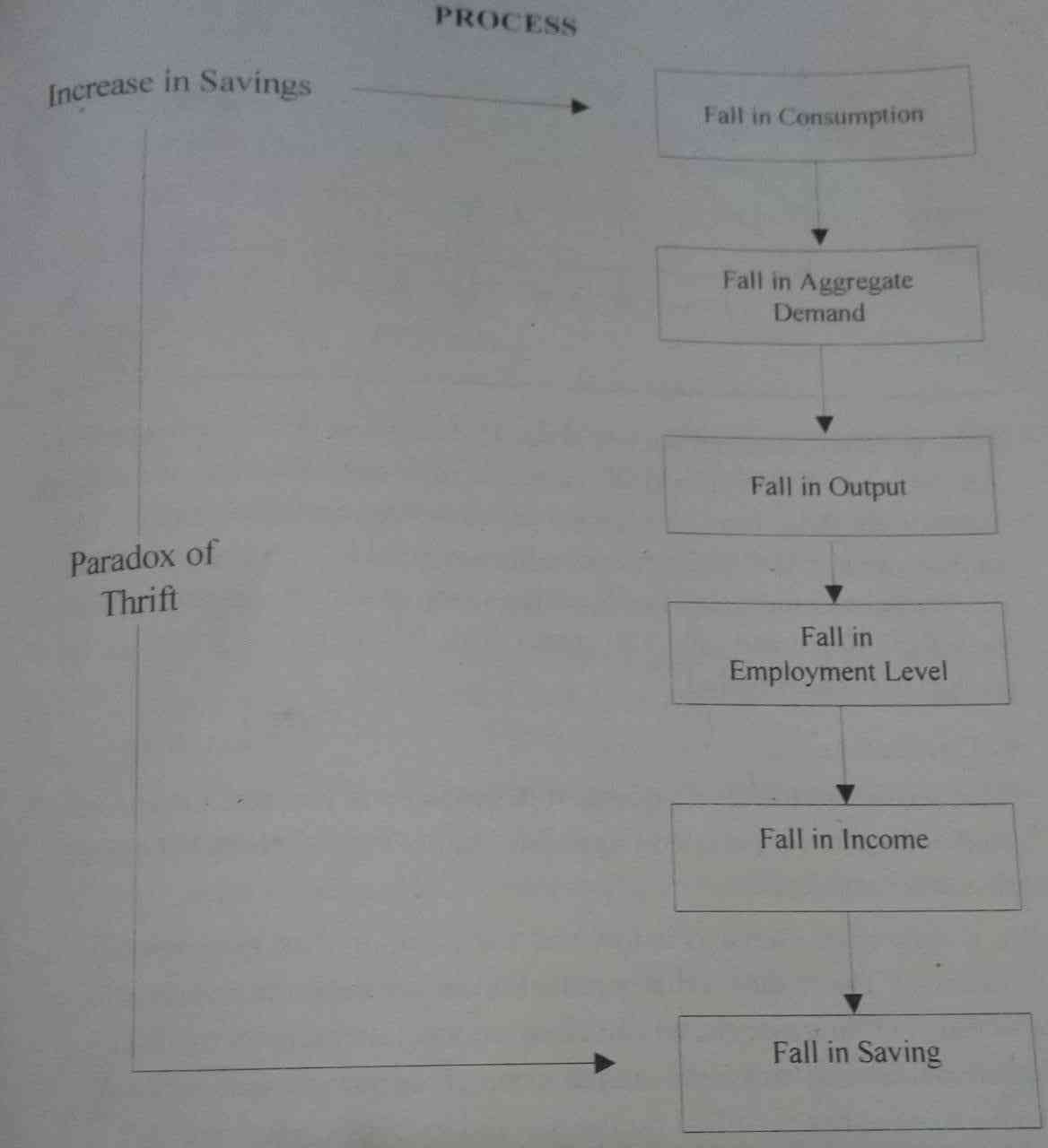

In the above diagram, it is clearly shown how the initial savings were high. Still, subsequently, the final savings or savings in the next period has fallen because if MPC or Marginal Propensity to Consume is less, it will result in less expenditure for consumption. Thus, it will result in less income. Hereby, if the income is less then in the next period, the saving level will be less and then again, it will impact the same manner with the assumption of Ceteris Paribus. The flow chart below will clarify how the movement in the economy is going on w.r.t. this concept.

This gives rise to a question that when it is clear from the above diagrams that how savings are going to harm the subsequent income level as well as the consumption level in the economy then, why the hell we need to save? To kill ourselves?!

Well, J. M. Keynes also knew this but, what he did was a masterstroke! He also introduced the FI’s or Financial Intermediaries like banks etc. They accept your money as savings give you some rate of interest to encourage you to save more. On the other hand, it offers Investments to the entrepreneurs to invest it back into the economy at a rate of interest being charged on that. Hereby, this channelized the entire money being withdrawn from the economy and injects it back into the economy. Here, players like MPC, MPS (Marginal Propensity to Save), Multipliers play a pivotal role to see the money growing for all! Thus, a win-win situation for all.

So, finally, the western economists accepted the Indian concept of savings, which they always gave a bad look. Therefore, the Indian economy cherishes enormous savings across India, where savings are in the form of money with FI’s, gold or any precious commodities etc. I know that now some may ask a question that purchasing precious metals are investments not savings? Yes, from one side of the coin, it is investments. The other side of the coin say’s it’s a saving because you have withdrawn an amount of money from the circular flow of income to purchase the precious metal in the form of investment as a concept, but in reality, that investment in being now dumped in your locker! Now, such dumping is not actually an Investment but saving because saving is what is taken away from the flow and kept aside.

South India, Western Indian and Punjabis the Northern Indian community are well into savings in the form of precious metals, while across India savings in money form are also prevalent.

I was wondering since I was doing my Masters at Delhi School of Economics, the University of Delhi, and also while writing my book on Macro Economics concept of circular flow of income the same what I have just shared with you all. Well, to share more and a very interesting aspect of the circular flow of income and the caveat of Paradox of Thrift, which has been kept silent from many learners across the Indian students at large safely I can say, is that the underlying idea has been missing that I have highlighted in my book, (“Business Economics 2” by Parragon Publishing India) “The Maximising concept on the part of Consumers and Producers.”

Trust me very beautifully, the various authors at large are not explaining this fundamental concept. The whole model has been devised, whether it is Circular Flow of Income or Indifference Curve analysis (The consumer side) or Iso – Quant analysis (The producer side) and so on.

As in my book, I have said that in an economy if the whole of money being earned by the workforce and the entrepreneur with the government has been put back into the economy shows the maximization of either consumption or profit concept which is also known as maximizing in naturewhether consumer or entrepreneur! Now, after understanding this aspect of the main players of the economy, just re-read the entire theory again, then you will understand this trap!

The famous Paradox of Thrift will disappear! Now, the next big question that comes out is who planted this philosophy invisibly into our minds? The key to this puzzle is Pure Capitalism because they are the ones for whom the maximization of profit is the most important objective function. Thus, if the consumer is not maximising in nature and is saving, then this means he or she is not spending the entire income on consumption. This will lead to fewer sales i.e., less profit to the capitalist. This way the capitalist can not maximize its profit! Now, please do not give me the cost accounting concept into this because these figures are only w.r.t. increasing the cost recovery or coverage aspect on production or product sales! The profit maximization in real sense is when I can cater to the entire demand based upon the entire income being spent for consumption purposes!

The Endnote

The Indian economy has a mixed set of consumers, where the proportion of consumers who are not maximizing in nature is high! This has helped the Indian economy to thread away from the crisis times again and again!

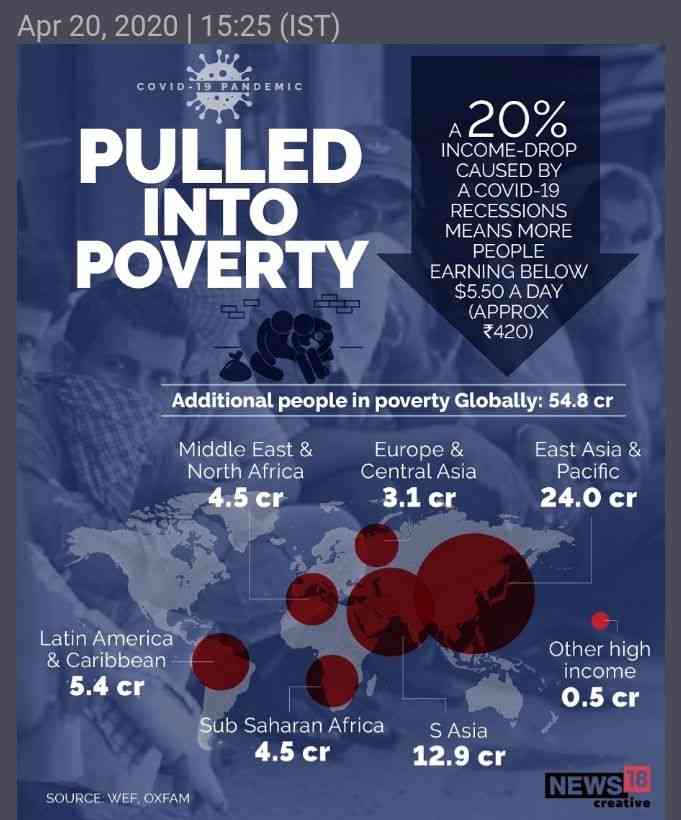

This time of global recession, where the Indian economy has too registered with a negative GDP growth rate with a -25% in the last quarter, looks huge and shocking. This number shall not be misinterpreted with the concept of Paradox of Thrift or global meltdown because of very high global debt of 258 Billion USD being 331% of world GDP! Rather, this negative GDP growth rate has been registered majorly on account of COVID – 19 Pandemic being faced by the world at large!

Hereby, this time is really tough because this pandemic has given a trade-off, which is very tactical. After all, every country needs to think in terms of Workforce Vs. National Income or GDP in current times! So, you save GDP today, you will kill your workforce for tomorrow and if you save this workforce of today, you will kill GDP today but cherish high GDP tomorrow!

Choice needs to be wise! That is why we in economics say, “Macroeconomics is a pain in the a**”!

Recommended reading: