Information About Inflation

#Inflation #Economic #Economy #Money #Prices #Economic_Problems

The concept of inflation The concept of inflation is the economic rate that leads to an increase in the overall level of prices for services and goods. This leads to a decrease in the purchasing power of the currency, and inflation is defined as the continuous and general rise in prices from other definitions of inflation, which is the excess of money in circulation with a decrease in the ability to buy.

Types of inflation:-

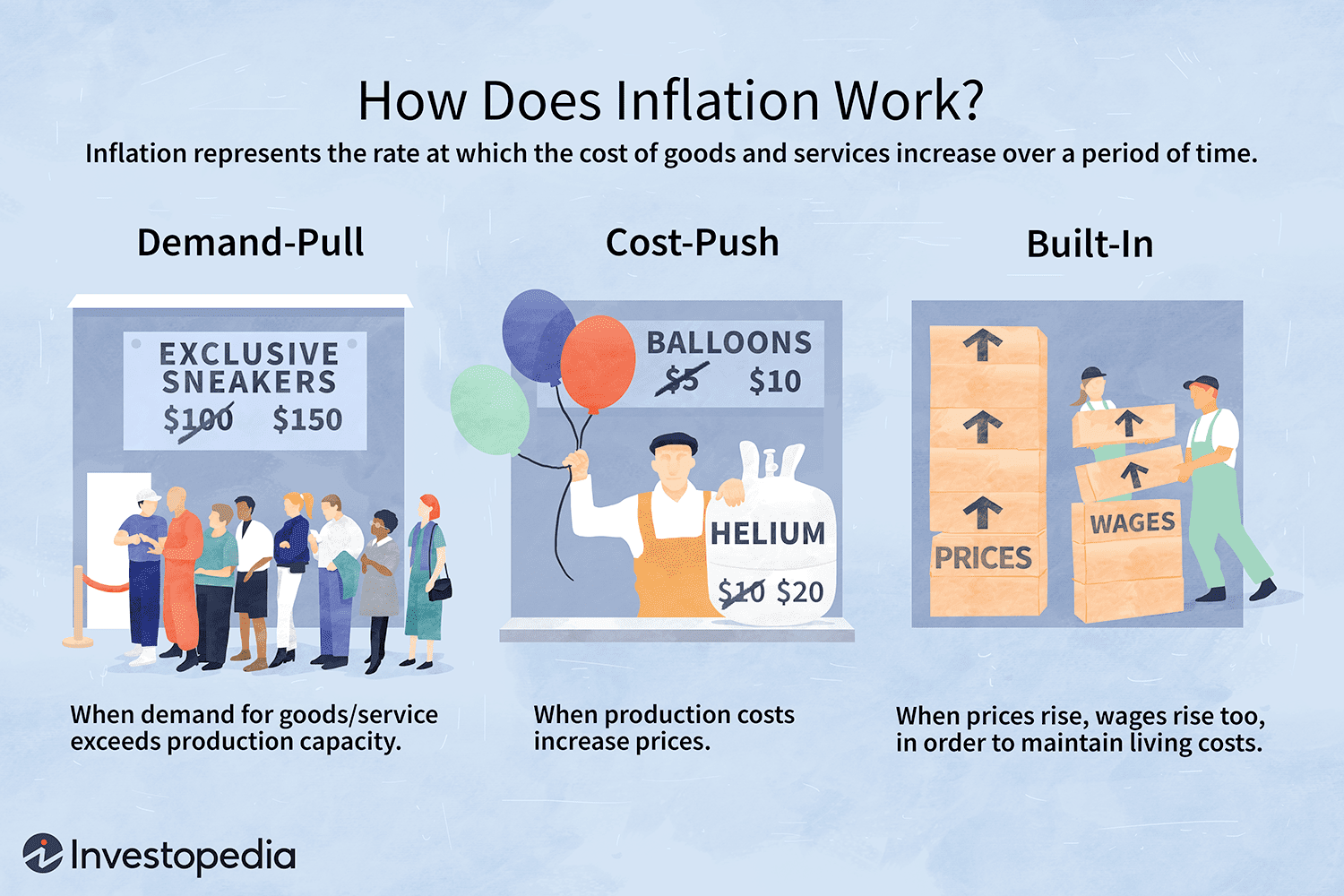

It is divided into a group of types, based on various economic criteria, namely: the criterion of inflationary pressure, and is divided into two types: demand inflation: is the increase in prices due to higher demand than supply; As a result, supply is unable to cope with the increase in demand Because of the full use of the productive elements, or because of the Elasticity of the means used in supply to meet excess demand.

Cost inflation: is the increase in the costs of factors of production at a rate that exceeds the rate of increase in production; This leads to an increase in the general price level, and among the most important productive factors are the wages of workers, which requires raising their rates, and increasing the levels of production benefits achieved.

The criterion of exposure to inflation, and it is divided into three types: apparent inflation: the governmental and monetary authorities take a negative attitude towards this inflation; This leads to the spread of its phenomena, its accumulation and its acceleration, so that the general price levels rise at a higher rate than the increase in money circulation for the traded quantities. Pent-up inflation: An economic condition in which prices are fixed, and subject to inflation pressure. Due to the freezing of public authority prices; In adopting Legislation or administrative decisions regarding this type of inflation.

Hidden inflation: an increase in appearance Marked with cash entry without a way to spend it; Due to the presence of state interference, various measures prevent the increased income from being disbursed; This causes inflation to remain invisible and not appear. The criterion of affiliation of the factors leading to the occurrence of inflation, and is divided into two types:

Domestic inflation:-

is the emergence of inflation as a result of local factors in the country, and external factors have no significant impact on its occurrence.

Import inflation:-

It is to increase the levels of domestic prices; Because of the influence of a group of external factors clearly.

The criterion of intensity of inflation, which is divided into two types: runaway inflation: the emergence of successive and severe price increases; Where it leads to the emergence of large and harmful effects, which are difficult for the government authority to limit or can deal with, as this leads to the loss of money to its value and purchasing power; This leads individuals to dispose of the money they have with them. Medium inflation:

It is an increase in the price rates by a rate less than runaway inflation, with a disruption in the role of money as a financial intermediary, but it does not completely lose confidence in it; Where the government authority can Rebalance its own jobs.

Characteristics of inflation:

Inflation is characterized as one of the most important economic phenomena by a set of characteristics, including: Inflation appears as a result of many economic factors that may conflict with each other; Therefore, inflation is classified as a complex, complex and multidimensional phenomenon. Inflation results from an imbalance in the relationships between the prices of services and goods, and the prices of productive factors such as product costs, wages, and profit levels. Inflation leads to a decrease in the value of currencies compared to prices for services and products, and this is expressed in the name of lower purchasing power.

History of inflation

Interest in studying inflation dates back to the nineteenth century AD; Since the academic focus was related to monetary inflation, when the money supply increases relative to the demand for it, this will lead to a decrease in its value. This results in an increase in price levels in general, but if the demand for money increases relative to its supply, it will increase its value, and the price levels will decrease.

The economic studies and studies of Keynes economist appeared and focused on focusing on factors controlling levels of national monetary income; Specifically related to propensity to consume, interest rates and marginal capital efficiency; This led to Keynes reaching the concept of inflation, which he considered to be an increase in the aggregate demand over the actual supply size. This contributes to a succession of continuous and sudden rises in the general price levels.

The Swedish Modern School was established in the second half of the twentieth century AD, and contributed to adding importance to economic expectations through monetary analysis used with inflation, so you see that the relationship between total supply and demand does not depend on national production plans and national spending plans, but rather depends on the relationship between savings plans And investment plans.

Reasons for inflation:-

The emergence of the inflation phenomenon depends on many reasons, the most important of which are: high investment and consumption expenditures: it is the increase that appears in the total expenditures from the full level of use, and the increase in the total demand reflects the total supply at the operating level, so inflation results from that increase; Due to the increase in total expenditures and the increase in the offered goods Any excess demand is offset by a constant supply of products and services.

The fiscal budget deficit: It is an increase in public expenditures compared to public revenues, and is one of the methods that governments rely on in financing productive projects under implementation, and the fiscal budget deficit generally affects the economic conditions of countries.

Lack of productive elements: is a decrease in the number of workers or raw materials, and other factors of production that affect the production process in general and lead to the emergence of inflation; As a result of lower supply and higher prices.

Decrease in kind capital: the emergence of a decrease in the capital used in the operational level, and leads to the Elasticity of production; As a result of the widening gap between the money offered and traded products and services, this leads to higher prices and the emergence of inflation.

Inflation rate

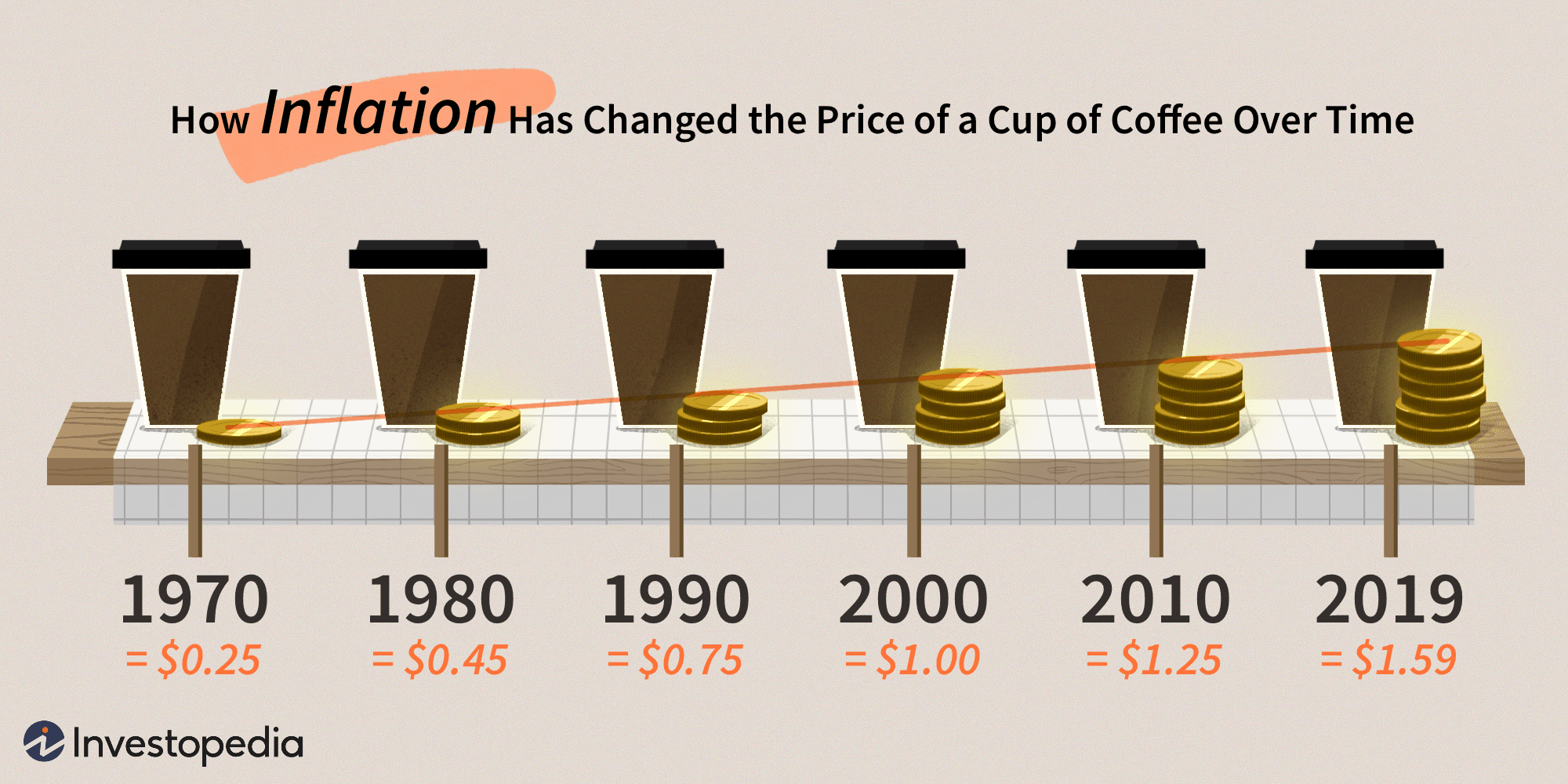

An inflation rate is a measure used to measure the extent to which currencies lose their monetary value; That is, the rate of inflation is used to measure the increase in prices of services and products over time, and the rate of inflation may rise as a result of the massive printing of money; This leads to an increase in economic supply and a decrease in demand. This also happens as a result of the scarcity of some important products, which results in a higher cost.

Thank You For Reading, Subscribe To Our Author's Page, Thank You.

-EnRi