Economics of Deflation

In current debates we all notice around economics... we have yet to agree on economic scientific facts. Economists have still not agreed whether deflationary or inflationary currency is more beneficial to all parties.

Science aims to prove facts through the scientific method. There are absolute facts, such as the Sun exists.

In current debates we all notice around economics... we have yet to agree on economic scientific facts. Economists have still not agreed whether deflationary or inflationary currency is more beneficial to all parties.

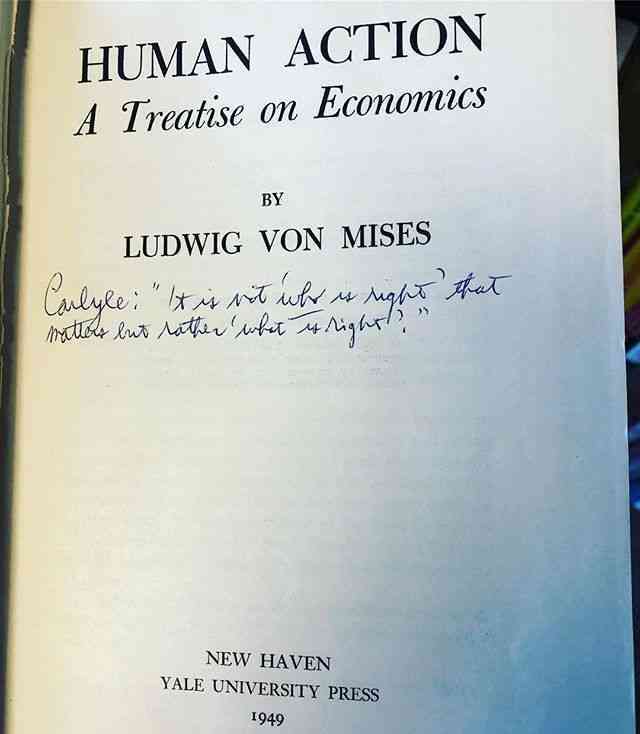

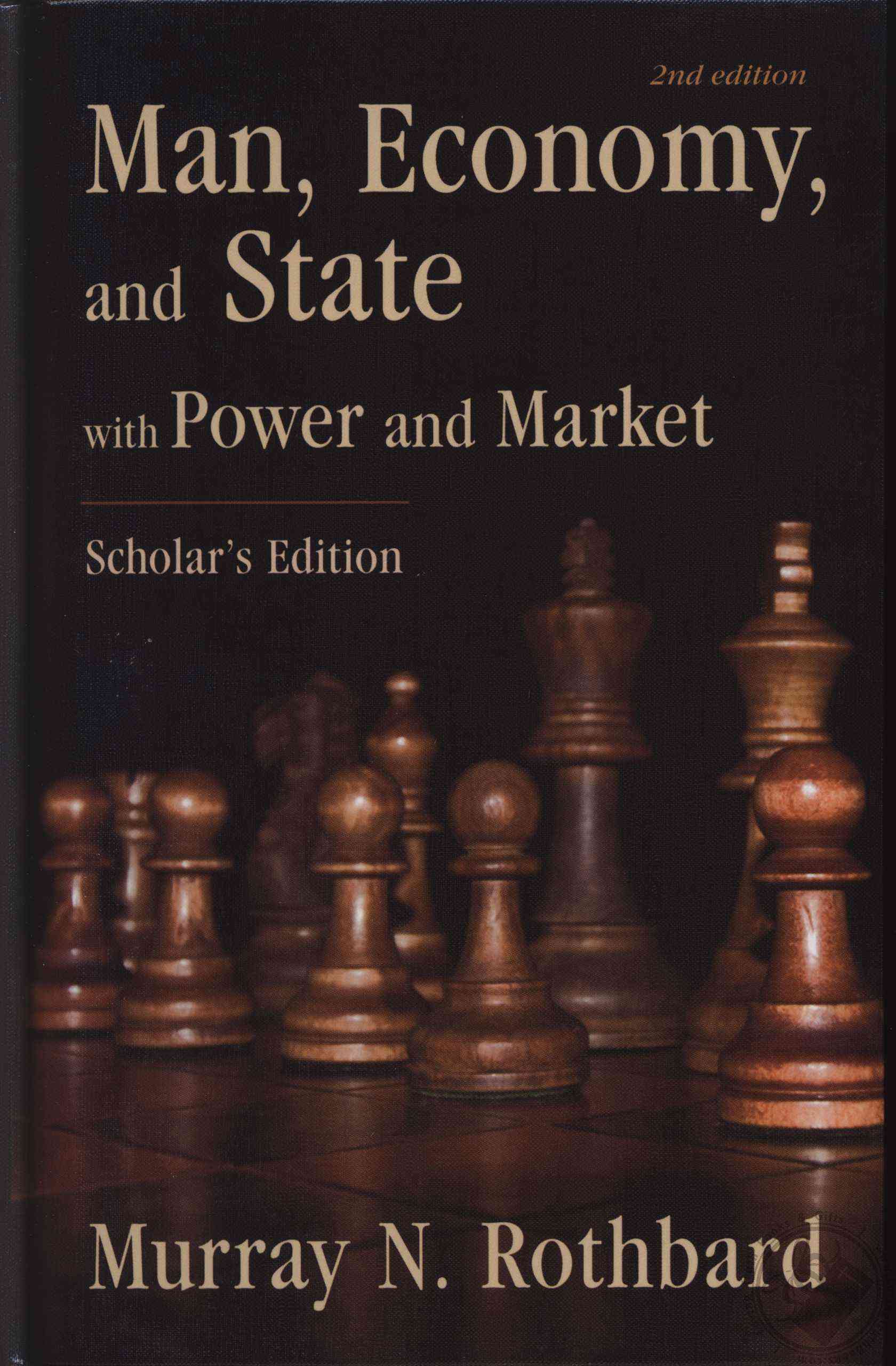

Man Economy and Truth and Human Action are two economic books that explain economic theory as scientifically as possible which are the accepted Treatise's of the Austrian school.

In this article we will explain what the current myth's are about deflation. I sourced all of these Myth's from Mises.org by Jörg Guido Hülsmann

- Myth 1: You cannot earn a living and make profits when the price level falls

- Myth 2: While falling prices are good, lacking aggregate demand is bad

- Myth 3: You cannot earn a living and make profits when the money supply shrinks

- Myth 4: Deflation entails slower economic growth than inflation

- Myth 5: Deflation is particularly burdensome for lower-income groups

- Myth 6: Deflation destroys the credit of the state

- Myth 7: Deflation creates unemployment

- Myth 8: Deflation entails unequal and arbitrary burdens for the citizens

- Myth 9: It will take decades to settle deflation-induced legal disputes

- Myth 10: Deflation confers no positive net benefit

- Myth 11: Letting deflation happen is “passivism”

https://mises.org/library/deflation-biggest-myths

Who does inflation benefit?

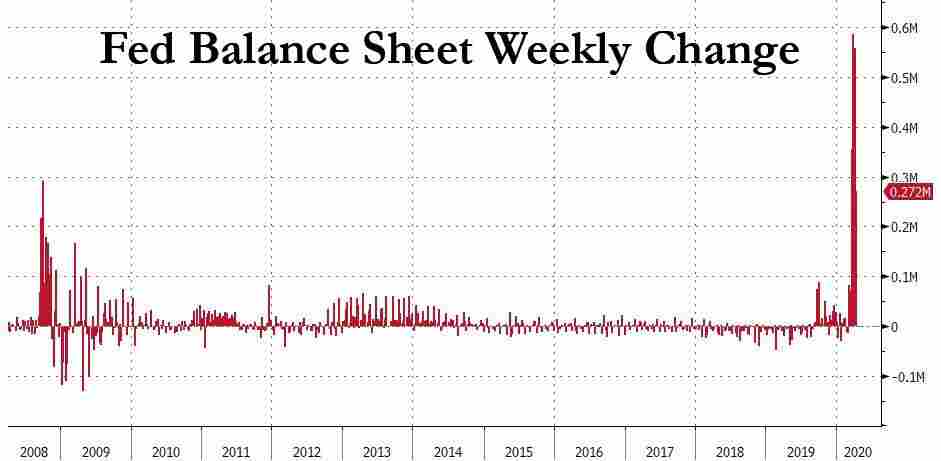

It depends on who controls the inflation, in America the Federal Reserve controls the inflation rate. They have an "open market committee" consisting of the 12 banks and they determine how much money to print, or how many assets to sell, taking money out of the system, causing deflation.

FOMC policymakers set monetary policy to foster financial conditions

they judge to be consistent with achieving the Federal Reserve’s statutory mandate of maximum employment, stable prices, and moderaten long-term interest rates. Monetary policy affects the U.S. economy—and the achievement of the statutory mandate—primarily through its influence on the availability and cost of money and credit in the economy.

source: federalreserve.gov

Certain policy makers, the 12 Federal Banks of the Fed have local members (Banks) and they determine what the inflation rate should be. Their goal is 2%, they consistently fail in endless examples, such as the price of gold, commodities, and food.

The people who first have access to the credit in the economy benefit the most. They get to spend their newly created money before the money supply is increased. Buying before prices rise.

Inflation will itself cause a redistribution in favor of the first receivers of the new money, it will distort relative prices, benefit debtors, prop up malinvestments, and potentially finance even new distortions and bubbles. It is completely understandable that those who benefit from inflation are spreading myths about the evils of deflation.

Philipp Bagus

Why is deflationary currency a better solution?

-

As money value increasees it promotes saving and careful spending

-

Sound entrepreniurial which action outpaces the value increase of money will only be supported

-

Malinvestment is discouraged

-

Interest rate could become negative as borrowers lend money knowing it will be more valuable when paid back

In Phillipp Bagus's interview in The Austrian he points out a time when we lived in a time of falling prices in America. This led to a lot of sound investments creating an American Utopia attractive to the rest of the world which set the stage for American middle class. We are still living on that momentum.

Of course. During the nineteenth century in many countries we observed falling prices caused by strong economic growth. In the book, I analyze in detail the United States from 1865 to 1896. During this period the US experienced thirty years of falling prices and a strong increase in the standard of living at the same time. In fact, the natural result of economic growth is that prices tend to fall and the population enjoys the increase in production in form of lower prices. Something we observe today in the technology sector.

Philipp Bagus