Bank of International Settlements Founding, Purpose, and Failure

The Bank for International Settlements (BIS) survived the immediate failure of its original mandate to become a permanent fixture in global finance. The text argues that the BIS pivoted from a reparations agent to a 'clubhouse for central bankers'.

Founding rationale

The Bank for International Settlements (BIS) was established on 17 May 1930, originally to manage German reparations payments under the Treaty of Versailles (Young Plan). The Treaty of Versailles (Young Plan) was adopted June 7, 1929.

Treaty of Versailles negotiators were “The Big Four” (France, USA, UK, Italy), Japan, Belgium, Brazil, China (refused final signature), Greece, Poland, Romania, and others.

Basics of the Young Plan during the Treaty of Versailles and actions taken by allied forces on the belligerent Germany were:

- 112 billion Reichsmarks (RM) over 59 years (to 1988)

- Payment schedule: 59 annual installments averaging ~1.98–2.05 billion Reichsmarks per year

- Ended foreign controls over German finances/railways;

- Created Bank for International Settlements (BIS) for transfers; tied to early Rhineland evacuation (completed June 1930); financed partly by ~US$300 million international loan.

The Young Plan led to the replacement of the Dawes Plan.

Owen Young is seated third from Left where the new reparation plan got its name.

There were many meetings and conferences that led to the founding:

- The creation and founding of BIS was first discussed at the Young Committee (Feb 9 – Jun 7, 1929) and initially was named the “International Settlements Bank”.

- First Hague conference (Aug 6–31, 1929), the political ratification of the Young Plan created the BIS in principle.

- Baden-Baden Organization Committee (International Bankers' Conference) (Oct 3 – Nov 13, 1929) was where the near-final founding texts were finalized in French, English texts added later.

- Second Hague Conference (Jan 7–20, 1930) the Young Plan & BIS legally adopted Jan 20, 1930 and signed the official charter (Germany, Belgium, France, UK, Italy, Japan + Switzerland as host).

- In Rome, Italy at the BIS Constitutive Meeting (Feb 27, 1930) founding central banks + US banking group signed a constitutive instrument and the BIS was legally incorporated under Swiss law.

The Young Plan was short-lived due to global economic depression, and the first major action of the BIS was a complete failure. The plan was suspended by the Hoover Moratorium in 1931 and essentially canceled at the Lausanne Conference in 1932. The founding rationale was to aid in international reparation and trade disputes as a ‘neutral’ party. While it seems great, immediately as these bankers coalesced the world was plunged into an economic depression.

Here is the timeline of the complete failure of BIS’s first action:

- Jan 1930: Young Plan adopted; BIS created to manage it.

- May 1930: BIS opens its doors in Basel.

- May 1931: The Creditanstalt Collapse. The largest bank in Austria fails. This is the BIS's first "911 call." The BIS tries to organize a rescue loan, but it is too slow and too small. The contagion spreads to Germany.

- June 1931: Hoover Moratorium. President Hoover realizes Germany is about to collapse and pauses all reparation payments. The BIS's primary job (collecting reparations) is suspended after just 13 months.

- July 1932: Lausanne Conference. Reparations are effectively cancelled. The BIS's original purpose is now officially obsolete.

If any private company failed its primary objective this badly within two years, it would be liquidated. The BIS, however, pivoted to becoming a clubhouse for central bankers, where they could meet secretly, smoke cigars, and plot world central bank policy. Good for the bankers, not so good for the people worldwide.

BIS and the FDR gold seizure in America

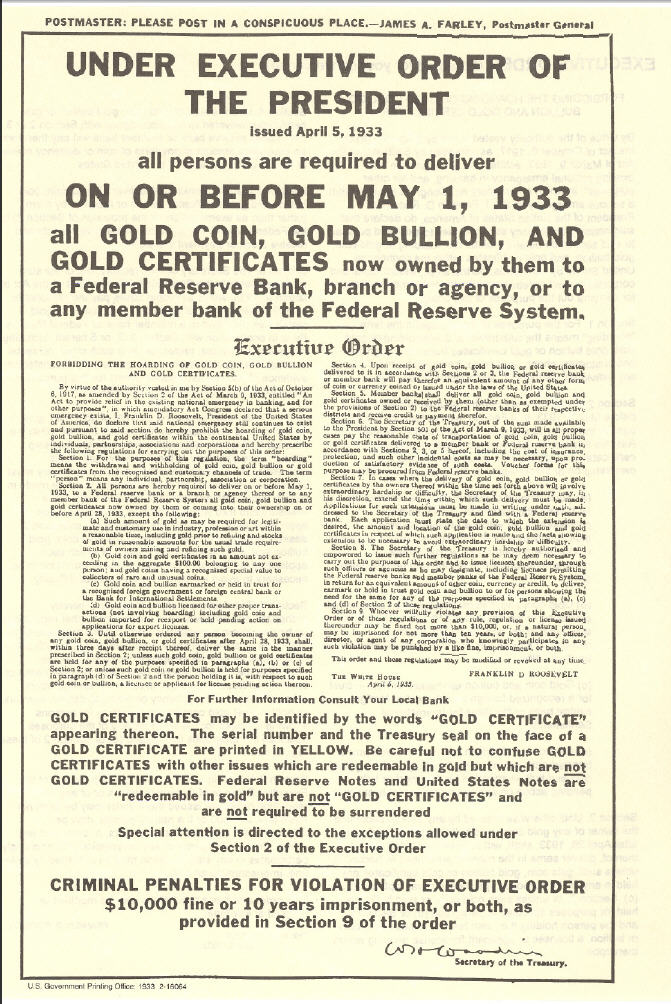

On April 5, 1933, FDR signed the Executive Order 6102 criminalizing the possession of monetary gold by any individual, partnership, association, or corporation. Specifically FDR made exceptions for the Bank of International Settlements.

The "Smoking Gun" Text

Section 2. All persons are hereby required to deliver on or before May 1, 1933, to a Federal Reserve Bank or a branch or agency thereof or to any member bank of the Federal Reserve System all gold coin, gold bullion and gold certificates now owned by them or coming into their ownership on or before April 28, 1933, except the following:

(a) Such amount of gold as may be required for legitimate and customary use in industry, profession or art within a reasonable time...

(b) Gold coin and gold certificates in an amount not exceeding in the aggregate $100.00 belonging to any one person...

(c) Gold coin and bullion earmarked or held in trust for a recognized foreign Government or foreign central bank or the Bank for International Settlements.

(d) Gold coin and bullion licensed for other proper transactions (not involving hoarding)

Executive order 6102 resulted in centralization of gold, sound collateral accepted worldwide, into vaults controlled by the central bankers of the world. Also, the gold price paid to US citizens was fixed at $20.67 USD. And 1 year later the USA Government and Federal Reserve revalued gold to $35 in 1934, resulting in a 70% profit for the government. Leading the citizens into the great depression.

When FDR signed Executive Order 6102 in April 1933, citizens were ordered to turn their gold into "a Federal Reserve Bank or a branch or agency thereof."

The gold seized in the USA was first owned by the Federal Reserve. On January 30, 1934, Congress passed the Gold Reserve Act. This law forced the Federal Reserve to hand over all the gold it had just collected from the citizens to the U.S. Treasury, where it remains today in places such as Fort Knox, and the NY Fed (still owned by Treasury).

Bretton Woods conflict with BIS

The Bretton Woods conference (1944 in New Hampshire, USA ) established a new financial architecture centered on the International Monetary Fund (IMF) and International Bank for Reconstruction and Development (IBRD). During these negotiations, several delegations argued that the Bank for International Settlements (BIS) was incompatible with the new global financial order, leading to an official recommendation that the BIS be liquidated:

At the Bretton Woods conference, Resolution V formally called for the “liquidation of the Bank for International Settlements at the earliest possible moment” because of its collaboration with Nazi Germany.

The fundamental issue arose from the entangled roles, wartime controversies, and the desire by Bretton Woods planners to create a modern US-led monetary system free from pre-war institutions based on the European system. At first, the United States, the United Kingdom, Norway, and other nations, together with their delegates, suggested the dissolution of the Bank for International Settlements, asserting that the IMF already covered the BIS intended role in global monetary cooperation.

The following were the main arguments against the extension of the lifetime of the BIS as presented at the Bretton woods conference:

- Functional overlap with IMF: the delegates at the conference stated that the IMF would take over the functions of the BIS in relation to exchange rate stability and international monetary transactions, thus making the BIS redundant in this aspect.

- Wartime controversies: The BIS did some financial transactions with Nazi Germany by accepting gold as payment

- Outdated institutional framework: the BIS was preserved by some officials as a pre-war European institution bound by the reparations regime and thus deemed unfit for the new world economic order.

- Creation of a new centralized system: The planners at Bretton Woods were not inclined to have a complex of overlapping institutions but rather wanted one IMF-supervised, unified, rules-based financial architecture.

The decision to liquidate the BIS was the official resolution of the Bretton Woods Conference, but the implementation of that decision was never carried out. The political backing for the dissolution of the BIS diminished after 1945 as the position of central banks, particularly in Europe, was that the BIS had a unique role to play as a technical forum for monetary cooperation. Moreover, the IMF would not be able to take over the functions of the BIS as it operated through governments and not through central banks, while the Swiss government was an ardent supporter of the continued existence of the Bank.

The BIS continued to function in the post-ww1 period and, eventually, its role expanded beyond its original contours.

The decision to dissolve the BIS was quietly shelved by BIS Board of Directors in 1948.

BIS actions during National Socialist (NAZI) German War

The Central Bank of Germany since 1876 until USA defeated the belligerents in 1945 was called Reichsbank.

- The Reichsbank remained a full BIS shareholder throughout the entire Nazi period.

- Key Nazi-Affiliated Directors on the BIS Board

- Transfer of Czechoslovak Gold After Munich and Occupation (1938–1939)

- Looted Belgian Gold Episode (1940–1942)

- May 1940: Belgium shipped 198 tons of gold to France for safekeeping; after France fell, the gold went via Dakar to the Banque de France’s account at the BIS.

- Reichsbank demanded the BIS transfer Belgian gold to its own account.

- Between 1941 and 1942 the BIS complied, allowing the Reichsbank to sell ≈$400 million (1940s value) of Belgian monetary gold on the Swiss market and elsewhere.

- Confirmed by the 1946 U.S. Treasury “Kilgore Report” and the 1953 Rogers Report (official Belgian government investigation).

- 1942–1944: BIS accepted looted gold from the Reichsbank (including dental gold and jewelry from concentration-camp victims) and converted it into Swiss francs for German use. Quantities are documented in the 1997 Eizenstat Report and the 1998 Bergier Commission (Swiss official inquiry).

- American BIS President During the War

- U.S. Treasury and OSS files (declassified) describe McKittrick as extremely accommodating to German requests.

BIS in the modern economy

BIS is the main global platform for cooperation, research, and regulatory guidance among central banks in the present economy. In the course of time, this institution has changed its position greatly from its initial role of administering German reparations and facilitating the monetary coordination during the interwar period.

To a large extent, the modern central bank system owes its functioning to the following major actions of the BIS:

- Central bank cooperation and forums: the BIS offers a "neutral" site where central banks can meet and discuss things like information exchange , coordination of monetary policies, and world financial challenges handling the forums helps in lowering the systemic risks and at the same time security of the stability in the global financial markets.

- Banking regulation and supervision: The BIS, through the Basel Committee on Banking Standards, which consists of capital requirements and liquidity frameworks. The implementation of these standards makes the global banking system more resilient and less crisis-prone.

- Research and economic analysis: advanced BIS research is centered on the topics of monetary policy, financial stability, and macroeconomic trends. The research results are used by policymakers in making decisions about interest rates, reserve requirements, and crisis prevention strategies.

- Financial services for the central banks: BIS also offers an environment to its member central banks for transactions in gold and foreign exchange, as well as for transactions related to collateralized lending and investment.

- Innovation in digital finance and payments: The BIS is investigating the use of central bank digital currencies (CBDCs), cross-border payment systems, and other fintech solutions that lead to the global improvement of customer satisfaction through increased efficiency, reduced transaction costs, and enhanced financial inclusion.

- Sustainable finance and climate risk: The BIS is drawing upon the link between the climate-related risks and the financial system. One way the bank is doing this is by publishing reports and academic papers on its own, as well as by hosting and participating in conferences.

Through these actions, the BIS contributes to the illusion of modern banking success, positioning itself as an essential institution for modern financial governance while the rich get richer, and the poor get poorer. Inherent in any central-planned economy.

Conclusion

While economic coordination and action is grand and produces wealth. Many actions of the BIS since its founding have resulted in a world burdened by fiat inflation, government debt, rampant entangling alliances, and war. BIS’ first purpose was to handle the economic reparations from Germany in World War 1, which they failed miserably at, resulting in another World War, and currently Europe is in the deadliest war since World War 2 in Russia/Ukraine.

In 1929 just before the crash wealth was concentrated in the top 0.1% where they owned about 25% of all wealth. Between 1934 and 1971, the US Dollar was the world's reserve currency because the US Treasury promised to redeem dollars held by foreign central banks for gold at $35 per ounce..

Since 1971, the wealth concentration has almost returned to the exact level it was in 1929. It is very clear that this group of central bankers have the wrong monetary policies forced on every jurisdiction.

The BIS has been through nearly one hundred years of complicated global financial crises and has completely changed its role from being an institution for settling reparation and debts between member banks and now operates as a central bank club.

The BIS continued to be a part of the global financial system through all it's failures, it is still a major player in fraud with a global financial system based on incorrect economics.

The BIS should be liquidated, and exposed for what they have done to debtor nations, collaboration with Nazi bankers, and centralization of sound money collateral. BIS intervention in banking and the money supply has caused massive instability, war, concentrated wealth, and inevitably has caused problems in the worldwide market economy.