GST 2.0 - The Toothpaste Revolution

There are two kinds of revolutions in life.

One is dramatic—the kind that makes it to history textbooks, with people on the streets, flags waving furiously, barricades on fire, and someone making a rousing speech from the back of a truck, usually with terrible acoustics. These are the revolutions that get movies made about them, complete with background scores, slow-motion shots, and someone yelling “Inquilab” in sepia tones.

And then, there are the quiet revolutions. The ones that don’t involve gunpowder or slogans but sneak into your daily routine. No barricades here, just bathroom cabinets. No fiery manifestos, just a little extra change in your wallet because—believe it or not—your toothpaste got cheaper. A silent coup against high prices, carried out in the most unlikely of places: the supermarket aisle.

Guess which one India is about to have?

Yes, ladies and gentlemen, welcome to GST 2.0—the most unglamorous yet profoundly impactful revolution of our time. No bonfires in the capital, no all-night vigils, no tractors on the highway, not even a “Quit Something” movement. Instead, this is a rebellion led by toothpaste, shampoo, and, if you’re lucky, that entry-level hatchback you’ve been eyeing since the last Diwali sale.

It sounds ridiculous, doesn’t it? But here’s the thing: in a country where 1.4 billion people brush, bathe, and commute every day, a cut in GST is more powerful than a thousand protests. You may not chant slogans for Colgate or Maruti, but the day your monthly budget feels lighter, you’ll quietly join the march.

And that’s the beauty of it. While dramatic revolutions demand blood, sweat, and barricades, GST 2.0 is offering a revolution with discounts, simplified receipts, and maybe even fewer arguments with your CA.

Why Now? The Timing of a Makeover

India has been running on GST 1.0 since July 2017. Back then, it was marketed with the slick tagline “Good and Simple Tax.” Except, for many, it turned into “Great Stress Tax.” Businesses were tangled up like old earphone wires in monthly return filings, states sulked about revenue shortfalls, and the average consumer stood in the grocery aisle staring at a packet of chips, trying to solve the unsolvable riddle: Did this just get cheaper, or did the government just invent stealth inflation?

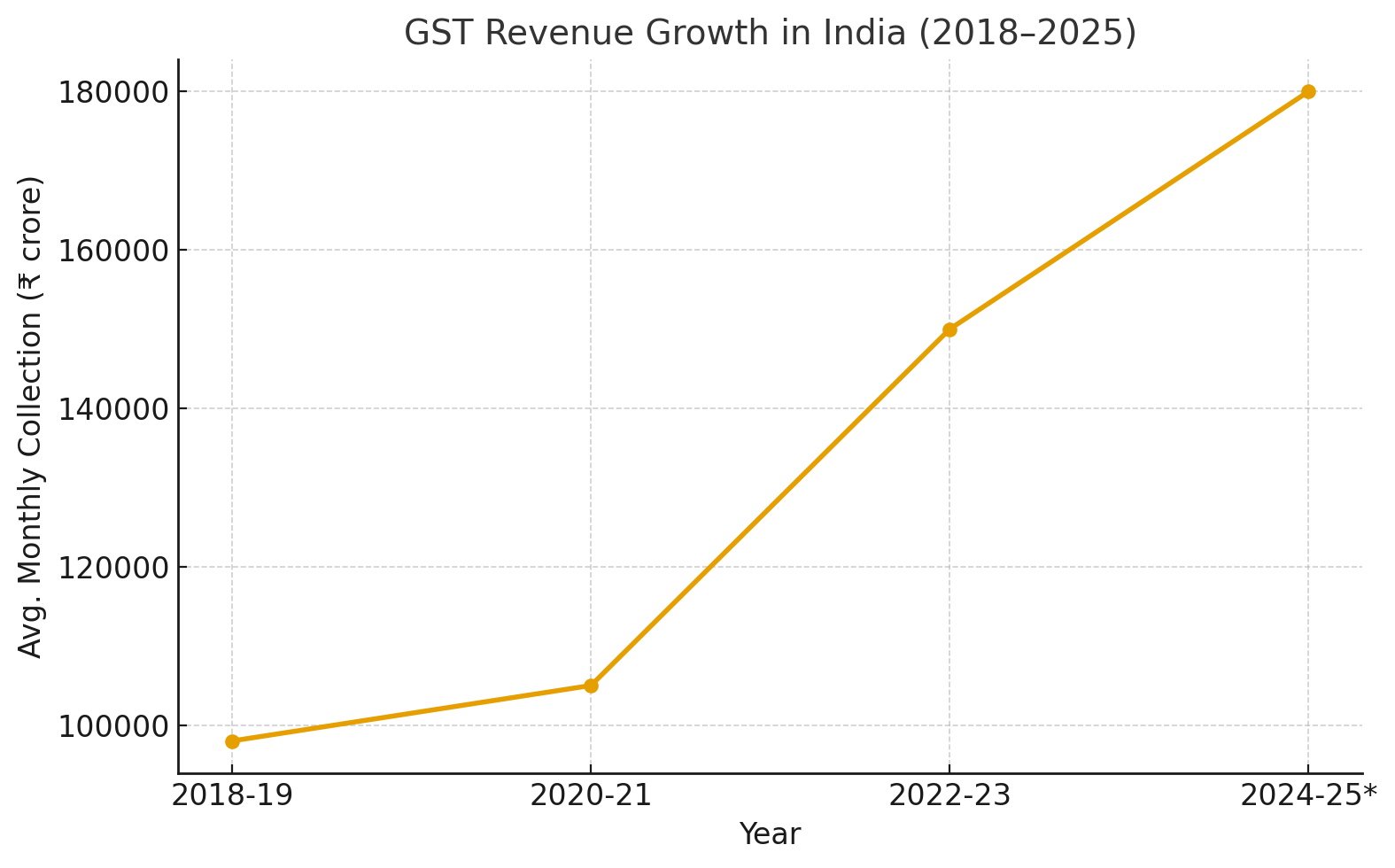

Still, despite the teething troubles, GST became the government’s biggest cash cow. Collections tell the story better than any economist can. In its very first full year (2018–19), monthly GST collections averaged about ₹98,000 crore. Fast forward to 2024–25, and we’re now averaging well over ₹1.8 lakh crore a month—with April 2024 hitting a record ₹2.10 lakh crore. In plain English: India’s tax kitty has nearly doubled in less than a decade, making GST the government’s Netflix subscription—annoying at times, but impossible to cancel.

But numbers don’t tell the full story. What they hide is the growing frustration with complexity. Businesses still deal with multiple slabs, input credit headaches, and compliance paperwork that makes filing a visa application look like child’s play. For a system built on the promise of simplicity, GST 1.0 often felt like ordering “simple dal chawal” and being served a ten-course molecular gastronomy experiment.

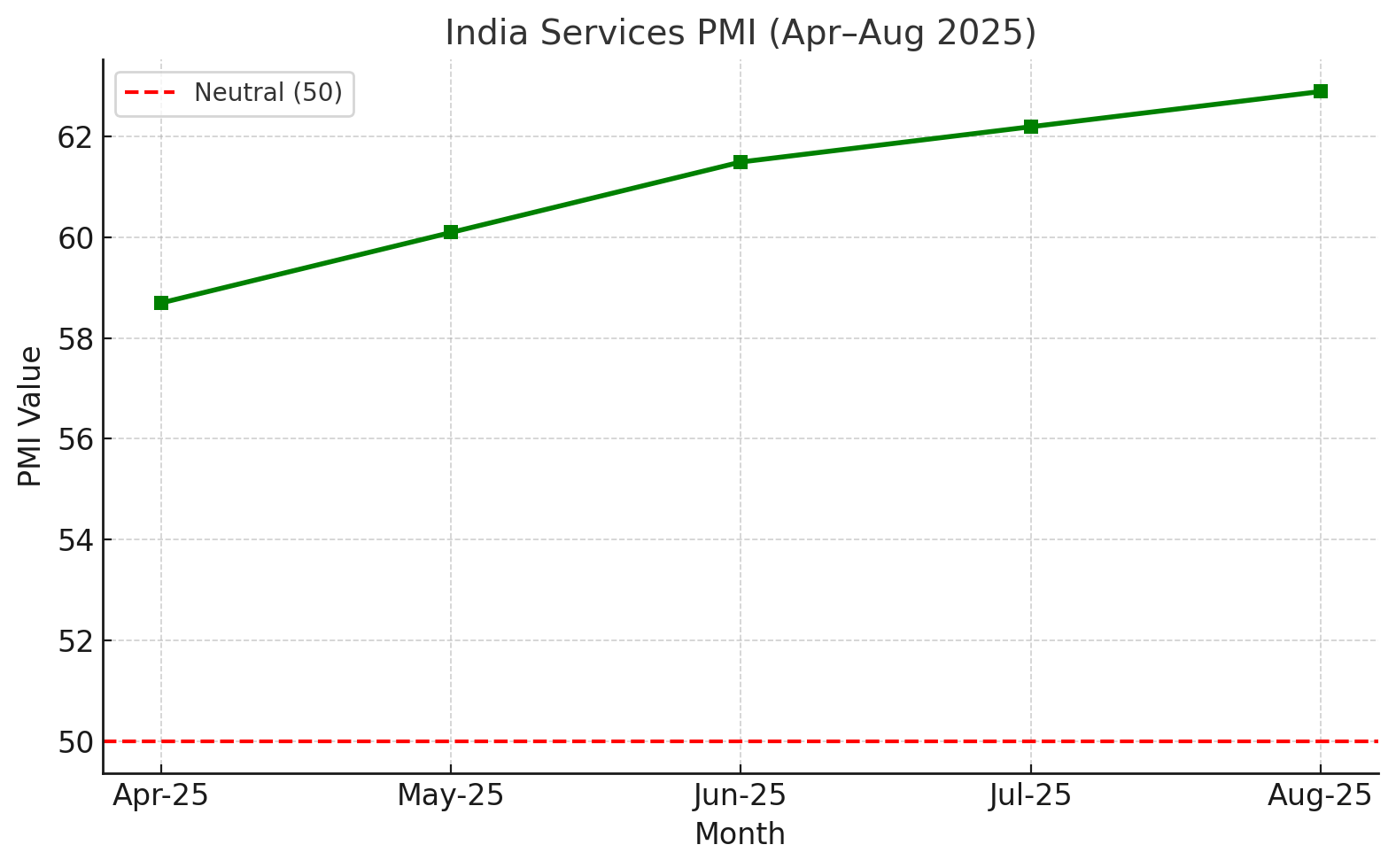

Now, let’s cut to 2025. The economy is buzzing, yes, but it’s also carrying some bruises. The services sector is sprinting like it’s on steroids (PMI at a 15-year high), but inflation is hovering like that relative who refuses to leave after dinner and keeps saying, “Bas ek aur cup chai.” Meanwhile, Uncle Sam has decided to play tariff-tariff with India, raising duties faster than a desi aunty raising eyebrows at inter-caste marriages. Add to this the seasoning of global wars jacking up oil prices, and voilà—you have the perfect recipe for reform.

That’s where GST 2.0 enters the chat, sipping chai and rolling up its sleeves.

The government’s new plan is bold: collapse the four messy slabs (5%, 12%, 18%, 28%) into just two neat ones—5% and 18%—while keeping a special 40% “luxury and sin” tax for the really indulgent stuff. Think Cuban cigars, imported whiskey, and Lamborghinis—the trifecta of “my life is better than yours.”

Translation? If you’re brushing your teeth in the morning, you’re saving money. If you’re lighting a cigar with a ₹500 note after dinner, well… let’s just say you’re funding someone else’s toothpaste subsidy.

This isn’t just taxation—it’s Robin Hood economics with a desi twist. Steal from the luxury elite, give to the middle class, and hope the middle class spends that saved money not on gold hoarding (old habits die hard) but on restaurants, shopping, and maybe even domestic tourism.

And here’s the kicker: the government isn’t being entirely altruistic. Every extra ₹100 that the middle class spends triggers a domino effect—more GST collected, more jobs created, more companies making profits, and more taxes flowing back into the system. It’s like giving the economy a Red Bull: wings attached, but with the expectation that the government gets a sip too.

But Wait, There’s Income Tax Too

GST may be the shiny headline, but the government also slipped in another sweetener: personal income tax reforms.

Now, for years, the Indian middle class has been cast as the ATM of the nation. Swipe in April, money deducted at source, and hope that someday, maybe, the refund fairy shows up. Most people in the ₹7–15 lakh annual income bracket have perfected the art of being too rich for subsidies but too poor for tax havens.

Enter 2025’s new tax slabs. The government has widened the zero-tax bracket, eased rates in the lower bands, and given breathing space in the middle. If you were earlier paying around 20% on a chunk of your salary, you may now find yourself closer to 15%. Translation: you’ve got extra cash in hand to upgrade from Maggi to Zomato orders without guilt.

But let’s talk impact. According to CBDT estimates, the revised slabs will release around ₹35,000–40,000 crore worth of disposable income back into the economy in FY26. That’s money waiting to be spent on cars, travel, iPhones, and, yes, the occasional unnecessary air fryer.

And don’t underestimate the multiplier effect. Every time the middle class buys a new phone, it isn’t just Apple that smiles. The local courier company, the screen-guard seller, the chaiwala outside the store—they all get a slice of the pie. Economists call it the “consumption cycle.” I call it the “Swiggy-Zomato Economy”—because no matter what, it ends with someone ordering biryani online.

Of course, cynics will say, “But won’t this hurt government revenues?” Here’s the trick: it won’t. Why? Because a little tax relief fuels a lot of consumption, which in turn drives GST collections up. Remember April 2024’s ₹2.10 lakh crore GST haul? The government is betting on more of those.

So yes, income tax reforms aren’t just charity. They’re the state’s way of saying, “Spend, my children, spend. Your shopping cart is my treasury.”

And if you’re wondering whether the timing is political, the answer is: of course it is. But it’s also economic common sense.

Connecting the Dots: Toothpaste, Chips, and Chips

Now, you might be asking—what does toothpaste have to do with semiconductors?

Everything, actually.

Here’s where it gets fun. Because tax reforms don’t live in a vacuum—they ripple. And India, my friend, is playing a long game.

Think of it this way: GST 2.0 makes your toothpaste cheaper, income tax reforms give you more money to buy that toothpaste in bulk, and suddenly the FMCG sector is dancing like it just discovered caffeine. But the real masterstroke? Using that demand-driven growth to fuel India’s next moonshot: semiconductors.

Yes, chips. Not the Lays-in-blue-packet kind (though demand for those will rise too). I’m talking about the silicon wafers that power everything from your phone to your car to the drone that delivered your neighbor’s sneakers.

India has finally realized that depending on Taiwan for chips is like depending on your neighbor’s Wi-Fi—fast, but one wrong move and you’re offline. So, billions are being poured into semiconductor fabs in Gujarat, UP, and Tamil Nadu. The idea is simple: the services sector made us the back office of the world, now chips will make us the factory floor of the future.

And it’s already showing. The PLI scheme for electronics manufacturing has pulled in investments north of $10 billion, and with tax simplification boosting local consumption, every smartphone bought in Patna or Pune is one more reason for a global player to “Make in India.”

Now, let’s not kid ourselves. Building fabs isn’t like opening a chai stall—you don’t see profits in six months. It’s more like planting a mango tree. You spend years watering it while everyone around you wonders why you didn’t just buy bananas instead. But when the mangoes come, oh boy, they change the entire market.

Combine that with India’s services sector juggernaut—currently contributing nearly 54% to GDP, growing at 8%+— and you see the dots connect. Cheaper daily essentials free up spending. That spending drives demand. That demand pulls in manufacturing. That manufacturing needs chips. And suddenly, your toothpaste and your transistor are part of the same economic growth story.

The Boom in Services: India’s Old Faithful

Let’s be honest: India’s services sector is like that one reliable friend who always shows up. Not flashy, not dramatic, but when everyone else flakes out, they’re the one holding the party together. Since the 90s, when manufacturing was stumbling and agriculture was moody, services were the only one saying, “Relax bro, I got this.”

And it still does. In August 2025, India’s Services PMI hit 62.9—the highest in 15 years. Translation: the world can’t stop throwing money at Indian IT, consulting, banking, and back-office sorcery. Basically, we’re the therapist, accountant, and IT guy for half the planet.

But here’s the uncomfortable truth: we’re thriving, but it’s getting expensive to keep the show running. Inflation’s creeping up, input costs are biting, and output prices are climbing at the steepest pace since 2012. Imagine riding the fastest roller coaster of your life, but midway you notice the bolts are loose. That’s the services sector right now—fun, profitable, terrifying.

Now, this is where GST 2.0 and those shiny income tax reforms sneak in. They don’t solve all problems. They won’t magically stop global inflation or fix wage pressures. But they do one simple, powerful thing: they put more money in people’s pockets. And when people have more money, they spend it—on food delivery, on streaming subscriptions, on overpriced yoga classes, and yes, on tuition for yet another online MBA that no one needed.

That spending fuels services, which then fuels jobs, which then fuels… you guessed it, more spending. Economists call it the “multiplier effect.” I call it “middle-class retail therapy with tax rebates.”

And here’s the kicker: unlike exports, which can get messy with tariffs and trade tantrums, domestic services consumption is ours to control. You can’t sanction someone’s decision to order samosas on Swiggy. That makes the services boom not just an economic strength but also a kind of geopolitical shield.

So, yes, the sector has problems. It’s bloated, it’s stressed, and it’s riding the edge. But it’s also our safety net—the old faithful that refuses to quit, even when global markets are having yet another meltdown.

Tariff Tantrums and Trade Tinder

Now, no Indian economic story in 2025 is complete without mentioning Uncle Sam—because apparently, every time India takes two confident steps forward, the U.S. shows up like that insecure ex who suddenly starts posting cryptic Instagram stories.

Here’s the deal: the U.S. loves India’s growth, but it also hates losing manufacturing jobs. So, it plays a game I call “Tariff Tinder”—one swipe right for defense deals, another swipe left with duties on steel, pharma, or IT services. One day we’re “strategic partners,” the next day we’re “currency manipulators.” Honestly, if this relationship had a Facebook status, it would be “It’s Complicated.”

And just when things couldn’t get juicier, global wars have added seasoning to the stew. Europe is distracted, the Middle East is volatile, and China is busy trying to look unbothered while quietly sweating about supply chains. In this mess, India smells like stability. A messy, noisy, democratic stability—but stability nonetheless.

That’s why trade agreements suddenly matter. India has been cozying up to the EU, ASEAN, and the UAE while deepening its flirtation with Japan and Australia. Call it economic polyamory—because why settle for one partner when you can diversify your portfolio of allies?

But here’s the catch: making friends globally while fending off U.S. tantrums requires balance. Push too hard against Washington, and tariffs slap you in the face. Play too nice, and you risk being the eternal “back office of the world.” That’s where GST 2.0 and domestic demand come in. The stronger the Indian middle class, the less we have to beg for access to someone else’s market.

Think about it: if 400 million Indians suddenly upgrade their lives—from toothpaste to Teslas—that domestic consumption becomes a bargaining chip. You don’t just ask the U.S. to lower tariffs; you make them need access to India’s shoppers. It’s not “please let us in,” it’s “do you really want to miss out on the biggest mall opening in history?”

So, while the U.S. keeps swiping left and right on us, India is busy doing what every good millennial does after a messy breakup: building itself, hitting the gym (semiconductors), upgrading its wardrobe (tax reforms), and casually posting stories with new friends (trade agreements).

And honestly? That might be the best strategy yet.

When the World Burns, Who Holds the Hose?

Here’s the inconvenient truth: India’s economic story in 2025 isn’t unfolding on a calm stage—it’s happening in the middle of a global food fight.

Russia and Ukraine are still locked in their slow-motion slugfest, oil prices keep playing seesaw depending on who sneezes in the Middle East, and China is busy rattling sabers in the Pacific while pretending its real estate market isn’t collapsing like a badly made sandcastle. Toss in the occasional African coup or Latin American debt crisis, and you’ve got a geopolitical buffet no investor asked for.

And yet—India stands out. Not because we’re perfect (please, our bureaucracy can still turn a startup founder’s hair gray in six months), but because we’re relatively sane. In a world where everyone’s house is on fire, being the guy with a bucket of water makes you look like a hero.

But let’s not sugarcoat it: wars and global tensions squeeze us too. Oil imports get pricier, supply chains get choked, and inflation creeps in like that nosy neighbor who insists on borrowing sugar every other day. This is where the balancing act comes in.

On one hand, India needs growth—big, loud, headline-making growth. The kind that gets us invited to the G7 cool kids’ table. On the other growth without stability is like chugging five Red Bulls before a job interview—you look energetic, but you might faint halfway through.

That’s why GST 2.0, income tax reforms, and the semiconductor push aren’t just domestic housekeeping. They’re a buffer. They make sure India isn’t overly reliant on exports or oil prices to keep the lights on. They strengthen the middle class, who, in turn, keep the domestic economy humming, even if global trade has a bad hair day.

In short: while the world burns, India is trying to be the one holding the hose—not to save everyone else, but to make sure our own roof doesn’t catch fire.

And honestly, that might be the most grown-up decision we’ve made in decades.

The Bigger Picture: Toward Sovereignty and Competitiveness

So, what’s the real story here? Is it GST 2.0 making your toothpaste cheaper? Income tax cuts turning reluctant taxpayers into part-time spenders? The semiconductor factories slowly rising out of Gujarat’s dust? Or the services sector still grinding like the old diesel engine that refuses to die?

The answer is: all of it.

Because India’s economic sovereignty isn’t going to arrive in one grand, cinematic moment. It’s not Independence 2.0 where the British sail away and a tricolor flutters in slow motion. It’s a billion tiny choices stacked together—tax reforms that simplify instead of suffocate, manufacturing bets that look crazy now but brilliant later, trade agreements stitched together like a patchwork quilt, and a middle class that buys, spends, saves, and dreams a little bigger each year.

What makes this moment special is the timing. The world is stumbling—wars, tariffs, recessions, political circus acts. And here’s India, chaotic but somehow coherent, saying, “Fine, if you all want to fight, fight; we’ll just grow.”

That’s sovereignty—not in the chest-thumping “we don’t need anyone” way, but in the quiet confidence of “we have options.” If the U.S. sulks, we have Japan. If oil spikes, we have renewables. If exports dip, our middle class will binge-watch, binge-order, and binge-consume their way to economic momentum.

And global competitiveness? It’s not just about GDP numbers or FDI inflows. It’s about being taken seriously. When Apple moves a chunk of iPhone production to India, when Infosys closes a billion-dollar deal, when a fab plant actually produces its first wafer—that’s when the world stops seeing us as a “promising market” and starts seeing us as a player.

So which story best illustrates India’s path? Honestly, it’s the one where your toothpaste and your transistor are part of the same revolution. The one where making life slightly cheaper for 1.4 billion people fuels an economy big enough to matter globally. The one where our reforms aren’t just technocratic checkboxes but building blocks for resilience.

In short, the India story is no longer about catching up. It’s about showing up. Loud, messy, sarcastic, hungry, and very much here to stay.

And if that sounds less like a white paper and more like a stand-up routine—well, maybe that’s exactly how revolutions in India are meant to be told. And that, my friends, is why the biggest economic story of 2025 might just begin in your bathroom.