Important Info About Investment

#Investment #Rewards #Risk #Work #Low_Risk #High_Risk

The importance of money:-

Money is the main and essential component of daily life, for its commercial and practical uses as the basic element of any commercial process, and it is considered the official mediator that contributes to the continuation of life, as it is the element approved by people in order to buy their daily needs and requirements such as food and its components or other materials. Such as cars, household appliances and other matters of importance.

The funds consist of the first types of paper currency that are widely used today, coin and digital currency, Each country uses its own kind of currency, for example there is the US dollar and the European euro, and the money is considered the primary and the basis for investment of its various types. In this article, we will talk about the concept of investment.

The concept of investment:-

The concept of investment, which is called in the English language the term Investment, is defined as the sum of the total value and the amount of capital used in producing a group of services, goods and materials and providing them in the designated markets, in addition to the group of properties, assets and shares that individuals obtain to obtain money, where they are The investment process by placing an amount of money and investing it in a specific thing such as business, personal projects, companies or the stock market, The return on investment is considered a main measure of the performance of companies and institutions on the general economic level.

The investment includes two types: fixed income investment, which includes bonds, fixed deposits and shares, and variable income investment, which includes business and personal projects or real estate ownership and fixed buildings.

The investment and economic relationship:-

The concept of investment depends mainly on the economy, as it contributes very significantly to achieving economic growth for different countries, through the establishment of a set of sound capital investments at the level of business ownership or real estate ownership, which contributes to increasing production, which is the main contributing factor The country's high GDP, which positively affects the economic growth of the country and its various institutions.

The importance of investment also lies in providing a group of goods and services in the markets, reducing unemployment, increasing national income and contributing to raising the standard of living, and increasing the surplus that contributes to increasing the state's ability to export abroad, in order to maintain economic stability and achieve economic development globally, therefore The relationship between the economy and investment is considered to be interrelated, so that the higher and higher the level of investment, the higher the economic development.

What is the importance of investment:-

After learning about the concept of investment, it must be mentioned that it is considered the main ingredient in the economic development process, through which profits and returns are achieved for companies, institutions and individuals, through the positive effects of increasing income and capital through investment, and there are several benefits For investment, below comes an explanation of the most important:

- Providing the various specializations of technicians, administrators, and labor necessary to carry out all the different practical activities within the country.

- Providing job opportunities and reducing unemployment among individuals, which contributes to the revitalization and development of the currency movement.

- Increase the capital and material training rates of the country, as capital is the main component of economic growth.

- Produce goods and services that satisfy the daily needs of citizens, and contribute to stimulating marketing and sales movements for the country.

- Exporting the surplus of goods and services abroad, which provides the foreign exchange necessary for purchasing machinery and equipment, and increasing the capital formation.

- Providing services to citizens and investors in order to achieve the best results and economic and financial returns that contribute to raising the level of foreign trade for the country.

- Increasing production and productivity, which leads to an increase in national income and an increase in the average per Capita share of it, thus improving the standard of living of citizens and increasing the per Capita income.

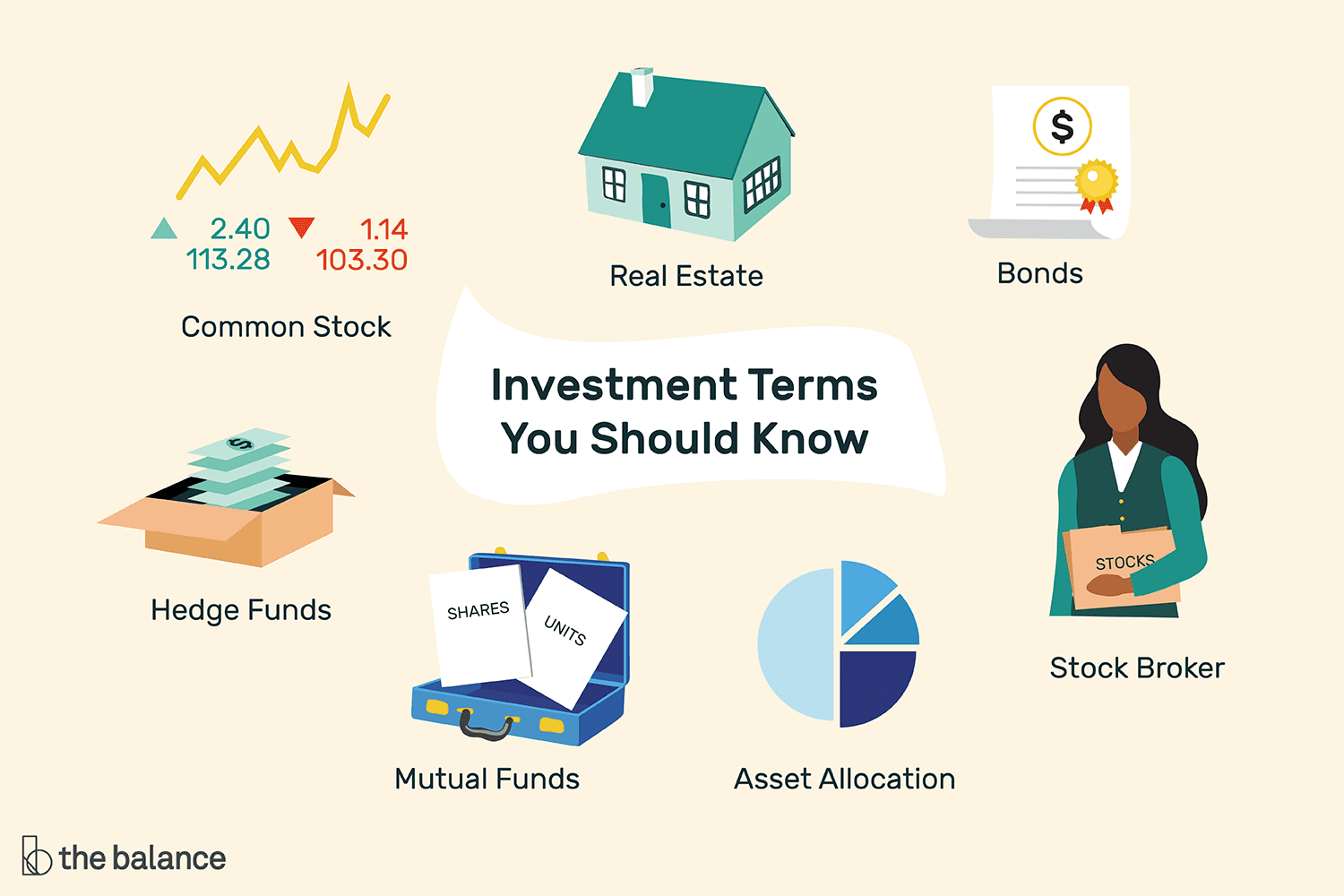

Types and methods of investment:-

The concept of investment varies so that it is divided into a group of forms that contribute to achieving high profit rates and internal and external economic development of the country, and the following is a breakdown of the most important types and methods of investment:

A. Real estate investment: Real estate investment is one of the most popular ways of investing and through which a group of commercial real estate is invested, whereby commercial or residential real estate is bought and sold in addition to residential or agricultural lands, which are bought and sold for the purpose of residential investment or agricultural trade.

B. Investment funds: They are defined as an investment tool that is managed by the investment manager, whereby investors can invest through stocks, bonds, or other investment tools, where investment funds are evaluated at the end of the trading day, and the transactions of buying and selling stocks are executed after the market is closed.

C. Equity investment: through which investment is made in international and local shares, and it is considered an essential component of mutual funds and stock exchanges, in which a group of individuals share a certain capital and a certain profit rate.

D. Trade exchange investment: It is defined as an investment tool that is traded on the stock exchange and during the trading day unlike the mutual funds that are traded at the end of the investment day.

Investment negatives and risks:-

Understanding the concept of investing helps in reaching an understanding that classifying financial risks as the group of risks that leads to an undesirable thing, such as the possibility of the company issuing the shares losses or the decline in profits or the decline in the market value of these shares, the investor always wants to increase the market value of his shares.

These risks are represented in the uncertainty of achieving the expected return on the investment, and it is the investor’s responsibility to reduce the risk factors that fall under his control in order to avoid any losses to the profits or the investment capital, and an important risk that may occur during the investment process is the currency exchange risks Foreign If the savings account currency differs from the local currency of the account holder, there is a risk that the exchange rate between the two currencies will move inappropriately, leading to capital losses.

Thank You For Reading, Subscribe To Our Author's Page,,, Thank You.

-EnRi