Iraq 1: Iraq-Iran War and its Effect on Iraqi Economy

The long years of the Iraq-Iran war put massive pressure on Iraq's economy. Iraq’s foreign exchange reserves fell to almost zero in 1985.

The Iraq-Iran war was an economic catastrophe for Iraq due to the war's depletion of its financial returns and accumulated surpluses, sabotage of oil export outlets, and a decline in exports compared to 1979. And then Iraq suffered a painful blow from Syria, when in April 1982 it closed the oil pipeline to Baniyas on the Mediterranean, which deprived Iraq of exporting (400) thousand barrels per day, thereby reducing exports to a minimum in 1983.

This fatal problem was gradually overcome by expanding the Iraqi-Turkish pipeline, as the pipeline capacity increased to about one million barrels per day upon its completion in July 1984. Iraq also started exporting nearly 60 thousand barrels of crude oil per day using tank cars through Jordan and Turkey. The most notable effort to expand Iraq's export capacity through pipelines was the export project through Saudi Arabia to the Red Sea, which was completed in September 1985 with a capacity of half a million barrels per day.

Also, an additional line was extended through Turkey, linking Kirkuk to the port of Ceyhan on the Mediterranean. That was accomplished in July 1987, which increased the export capacity of Iraq through Turkey by half a million barrels per day. By completing the second stage of the export line through Saudi Arabia in September 1989, Iraq could export the southern oil with a capacity of 1650 thousand barrels per day. Thus we described the export capacity of Iraq to reach 2260 thousand barrels per day by the year 1989.

Here it must be mentioned that the generous financial aid from the Arab Gulf countries, especially Saudi Arabia and Kuwait, which was estimated at one billion dollars per month, had eased the financial pressure on Iraq. The Kingdom of Saudi Arabia and Kuwait produced about 300 thousand barrels per day from the neutral zone between them for the benefit of Iraq. The value of those sales was estimated at that time by approximately 250 million dollars per month. And these quantities were not calculated within the upper limit of production allocated to Iraq within OPEC.

The long years of the Iraq-Iran war put massive pressure on Iraq's economy. Iraq’s foreign exchange reserves fell to almost zero in 1985. Iraq faced a lot of economic difficulties as a result of the collapse of oil prices during the year 1986. As prices fell by almost half from what they were in the year 1985 (the global average price of crude oil decreased from 26.5 dollars per barrel to 13.7 dollars), reducing the value of exports Iraqi oil fell sharply, and reached its lowest level, despite the increase in the volume of exports. The financial situation had also worsened as a result of the deterioration the US dollar is facing against other currencies.

Finally, the cease-fire between Iraq and Iran stopped in August 1988, without the financial problems of Iraq staying, as oil revenues decreased despite the increase in the volume of oil exports. And Iraq started suffering from major financial difficulties, as it was unable to service its external debt, the original debt, and the interest due. The (non-Arab) liabilities were estimated at more than 40 billion dollars, in addition to the Arab debts between 30 to 50 billion dollars, including eight billion dollars on conditions that require reimbursement. Iraq’s losses from oil revenues due to the war were estimated at 60 billion dollars. And some sources estimate the economic losses suffered by Iraq during the war at 452.6 billion dollars.

It is possible to measure the cost of the war that Iraq was exposed to by comparing it with oil revenues. While the total oil revenues for the period from 1931 to 1988 amounted to 179.3 billion dollars, we find that the war losses exceeded 452.6 billion dollars, which means Iraq wasted 2.5 times the oil revenues earned in 75 years only in eight years of the war.

Iraq emerged from the eight-year war with Iran, with a shattered economy, and its economic conditions were changed entirely. Iraq entered the war in the year 1980, and the value of its oil exports amounted to 20,096 billion dollars despite the collapse of its oil exports during the last quarter of that year. Its economy was very active, annually growing at a high rate exceeding 11%. By the end of the year 1988, its vast reserves of currency evaporated. The massive debts to the outside world and the value of its oil exports tumbled to 9,312 billion dollars, and this halted the rapid economic growth and destroyed an essential part of Iraq’s infrastructure. In contrast, the remaining portion suffered deterioration and disappearance due to the absence of maintenance and renewal.

The financial crisis experienced by Iraq as a result of the war has increased the oil prices in the world market during the first half of 1990, as the price per barrel of OPEC's basket of oil fell in the spot market from 19.98 dollars in January to 14.5 dollars in June. The deterioration of prices has been very painful for Iraq, which depends entirely on oil revenues for its hard currency requirements. Iraq has indicated that a drop of one dollar per barrel price leads to a loss of one billion dollars annually. Naturally, one of the reasons for the decline in prices witnessed by the oil market is the increase in demand for supply, which Iraq accused of both Kuwait and the United Arab Emirates in a planned process to dump the oil market with more oil production outside their OPEC quota.

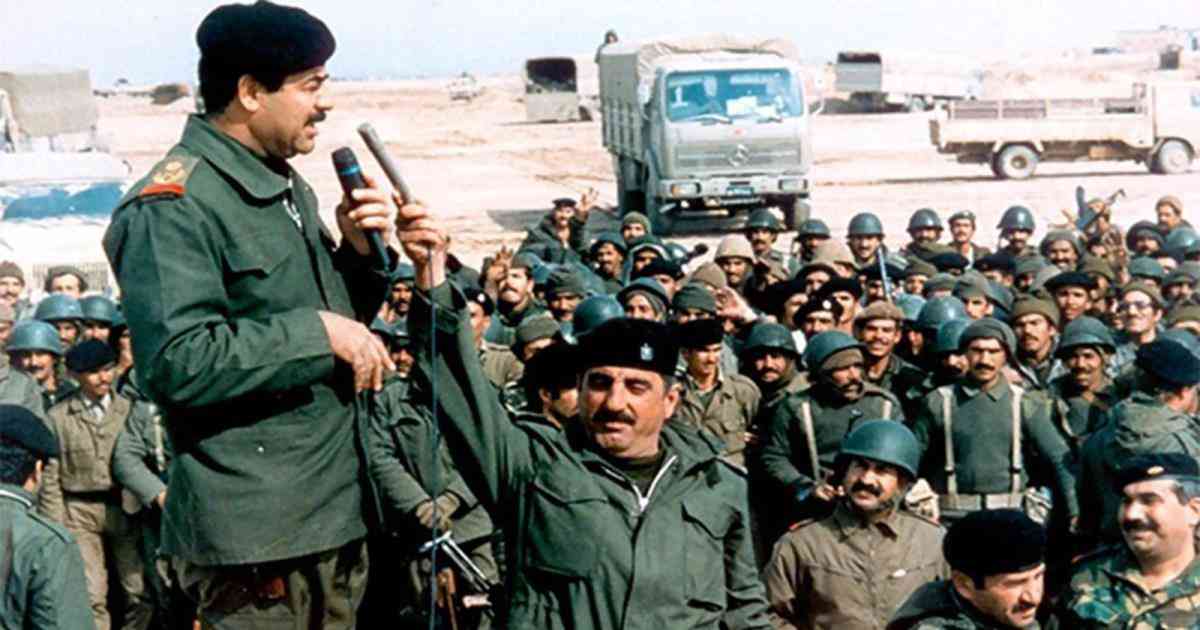

The Iraqi solution to this economic deadlock was the invasion of Kuwait on August 2, 1990, and Kuwait was annexed to it. And just four days after the invasion, a resolution of the most dangerous decisions issued by the Security Council against Iraq was issued, which was Resolution No. 661 on 6/8/1990, which imposed a comprehensive economic blockade on Iraq that lasted for thirteen years. After the issuance of that decision, Iraq's oil exports and those of Kuwait that was under Iraqi control stopped.