What is a bond?

Bond is an agreement between a company or business concern and people where business concern receives money in a fixed interest or coupon rate from a man or investor and what would be paid to investors by concern after a certain time period. Bonds were invented so that a company did not have to sell shares of its company; instead, it would issue debt labeled as bonds, often with company or future profit as collateral.

Here, whether a company could make a profit or not, investors hold the right to get interest based on the agreement.

So, bonds can be considered as loans.

How do bonds work?

Financing new projects and continuing the functions of a concern, companies need to take loan vs. sell shares. They can issue bonds to investors instead of taking a loan from a bank or selling shares. Issuer issues bond and interest would be paid based on agreement and book value of bond must be paid in the expiring year.

Interest rate, which is called a coupon.

1. Treasury Bond

Boosting capital, treasury bond is a debt tool of a business concern. It is called fixed revenue security as treasury bondholders get a constant interest rate based on agreement.

2. Governmental Bond

This is a loan based investment where investors provide loans to the government for interest. Boosting the current fund, building new project infrastructure or project government use this loan and investors use this to earn a specific portion within a particular time period.

Learn the fundamentals of economics:

3. Corporate Bond

This bond is issued by governmental and non-governmental companies. It is a securitized bond. Company issues corporate bonds for various purposes, such as new building construction, buying machinery, extending business etc. When somebody buys corporate bonds, the buyer gives money to the issuer and the company (issuer) gives commitment to investors to pay back the investment after a specific time in exchange for a loan.

4. Municipal Bond

Municipal bonds are issued by local government and agency. It comes from both investment grade and high yield and it’s an interest-free bond but it doesn’t mean that everybody will be benefited from it.

5. Convertible Bond

It is convertible into equity share, so it is called a convertible bond. Basically, investors get back their invested money after the expiring bond but this does not apply to this bond. In this case, the bond would be morphed into equity share in predefined value within an appointed time.

Want to show your love to the author? Donate here

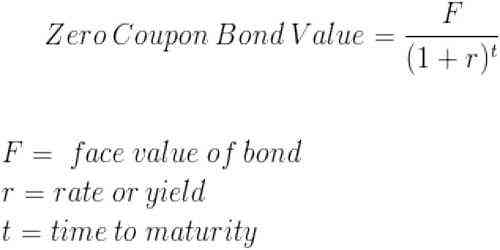

6. Zero coupon Bond

It is such a bond where no interest is provided against investment. It doesn’t imply that no yield would be gained by this bond. Zero-coupon bonds are declared in less value than book value, and in expiring time, the face value is paid to the investors.

7. Floating Bond

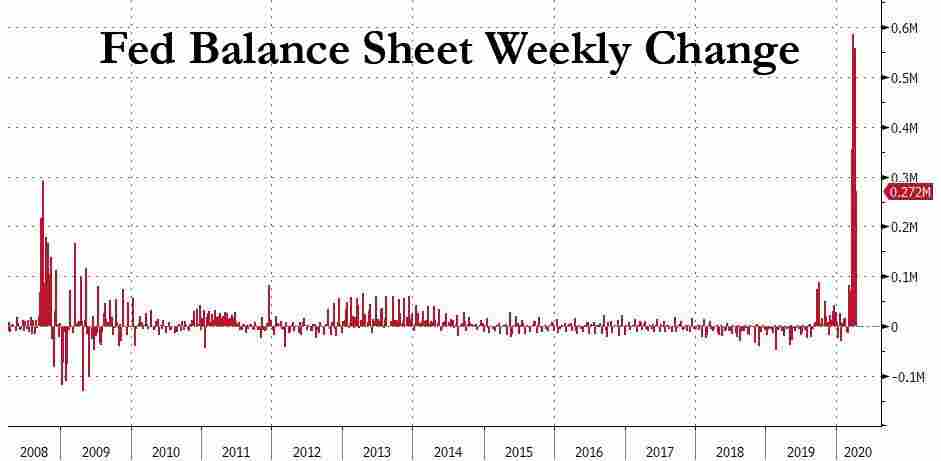

Literally, this sort of bond has been identified by a floating interest rate. It is called a floating rate note too. Floating rate notes are basically bonds that usually have a variable coupon. Adding up to a money market reference market, like the federal rate, plus a quoted spread. The spread is a rate that remains constant. Almost every business concerned has a quarterly coupon.

Thanks Mahedi for collaboration.

Next recommended reading for you: